Question: Question 2 1 pts When creating a two-asset portfolio, the expected return on the portfolio is the of the expected returns of each asset and

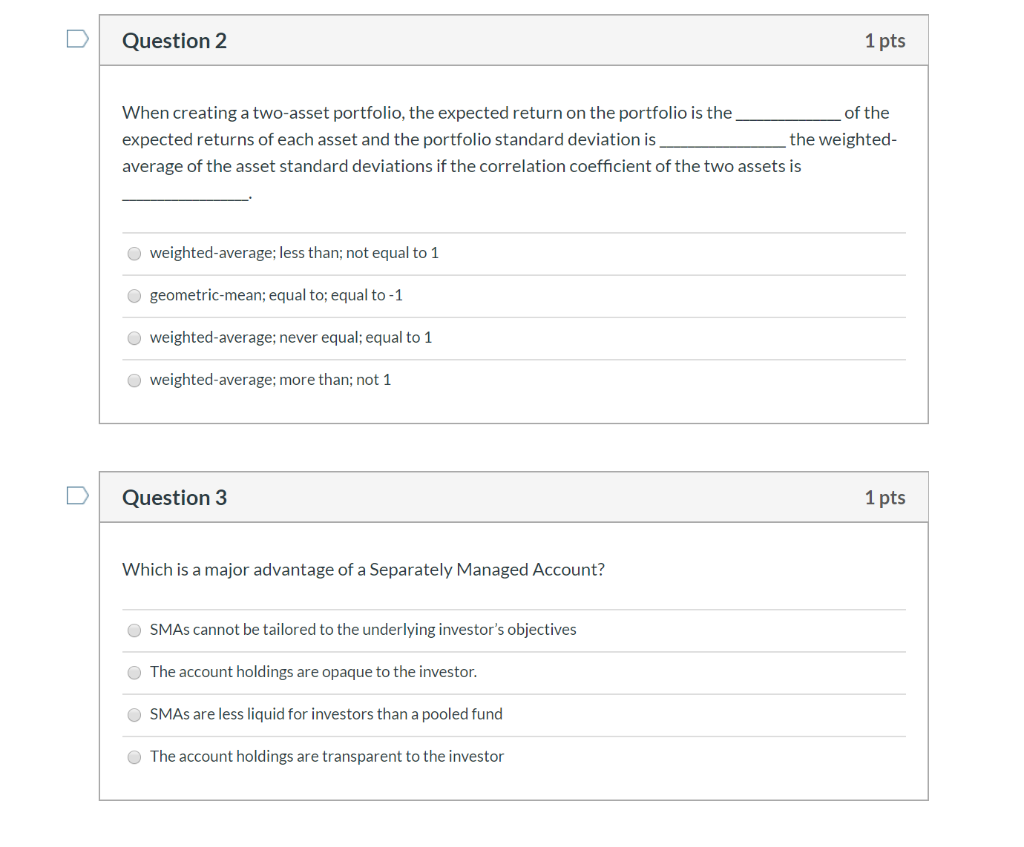

Question 2 1 pts When creating a two-asset portfolio, the expected return on the portfolio is the of the expected returns of each asset and the portfolio standard deviation is the weighted- average of the asset standard deviations if the correlation coefficient of the two assets is weighted average; less than; not equal to 1 geometric-mean; equal to; equal to -1 weighted average; never equal; equal to 1 weighted average; more than; not 1 Question 3 1 pts Which is a major advantage of a Separately Managed Account? OSMAs cannot be tailored to the underlying investor's objectives The account holdings are opaque to the investor. SMAs are less liquid for investors than a pooled fund The account holdings are transparent to the investor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts