Question: Question 2 1 pts Which one is false? The beta of a risk free security is zero If the expected return of a stock is

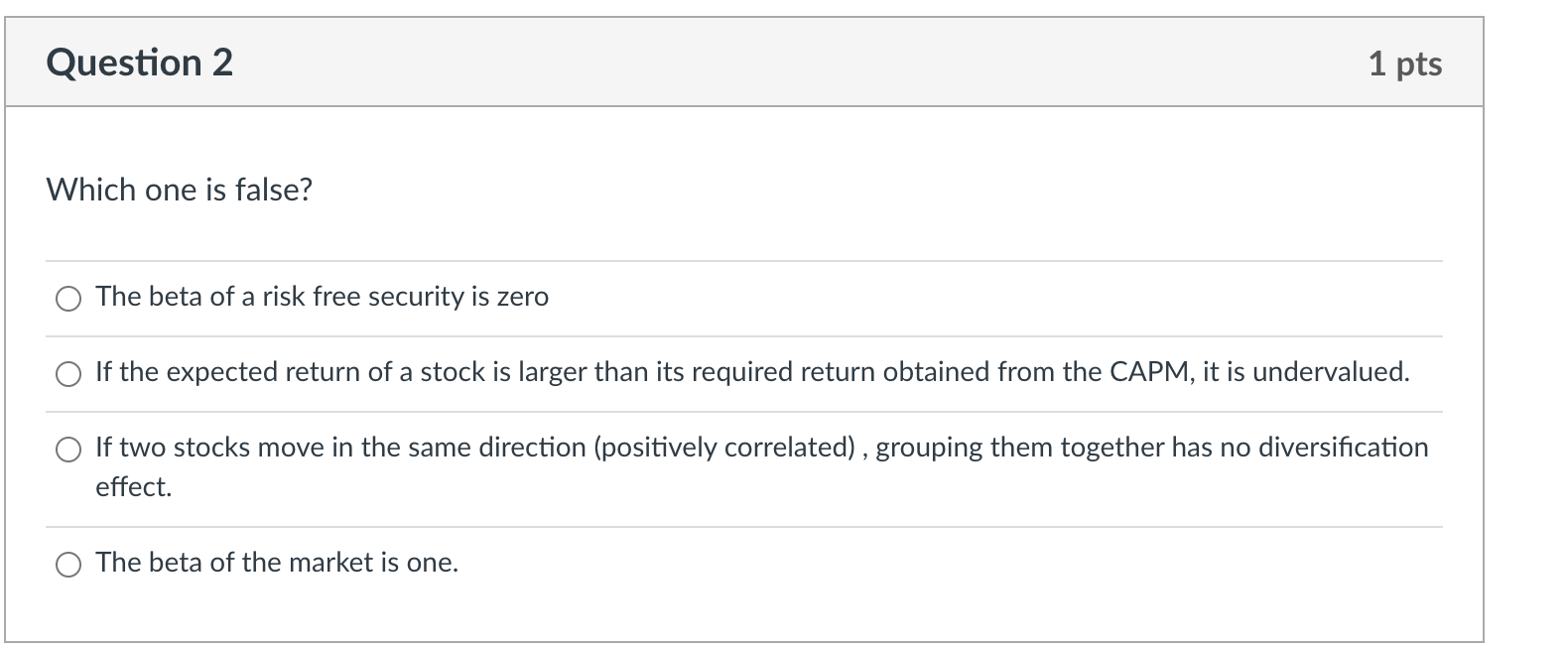

Question 2 1 pts Which one is false? The beta of a risk free security is zero If the expected return of a stock is larger than its required return obtained from the CAPM, it is undervalued. If two stocks move in the same direction (positively correlated), grouping them together has no diversification effect. The beta of the market is one

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts