Question: Question 2 1. Why are dividends not expensed when calculating net income whereas interest is expensed? (3 marks) 2. Using the definition of a liability

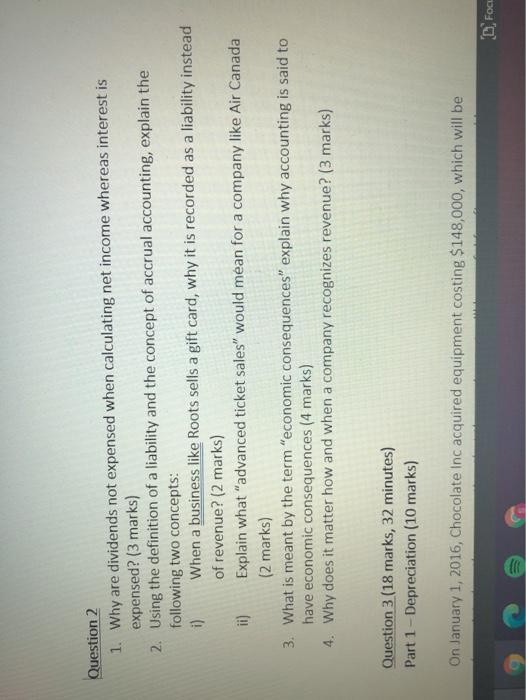

Question 2 1. Why are dividends not expensed when calculating net income whereas interest is expensed? (3 marks) 2. Using the definition of a liability and the concept of accrual accounting, explain the following two concepts: i) When a business like Roots sells a gift card, why it is recorded as a liability instead of revenue? (2 marks) ii) Explain what "advanced ticket sales" would mean for a company like Air Canada (2 marks) 3. What is meant by the term "economic consequences" explain why accounting is said to have economic consequences (4 marks) 4. Why does it matter how and when a company recognizes revenue? (3 marks) Question 3 (18 marks, 32 minutes) Part 1 - Depreciation (10 marks) On January 1, 2016, Chocolate Inc acquired equipment costing $ 148,000, which will be D. Focu

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts