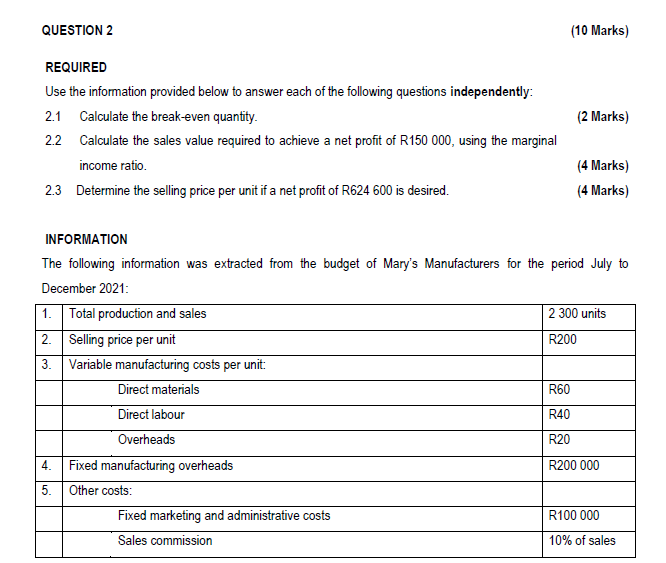

Question: QUESTION 2 (10 Marks) (2 Marks) REQUIRED Use the information provided below to answer each of the following questions independently: 2.1 Calculate the break-even quantity.

QUESTION 2 (10 Marks) (2 Marks) REQUIRED Use the information provided below to answer each of the following questions independently: 2.1 Calculate the break-even quantity. 22 Calculate the sales value required to achieve a net profit of R150 000, using the marginal income ratio. 2.3 Determine the selling price per unit if a net profit of R624 600 is desired. (4 Marks) (4 Marks) INFORMATION The following information was extracted from the budget of Mary's Manufacturers for the period July to December 2021: 1. Total production and sales 2 300 units 2. Selling price per unit R200 3. Variable manufacturing costs per unit: Direct materials R60 Direct labour R40 Overheads R20 4. Fixed manufacturing overheads R200 000 5. Other costs: Fixed marketing and administrative costs R100 000 Sales commission 10% of sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts