Question: Question 2 (10 marks) According to the data on Yahoo Finance, Stock A has a beta of 1.5 and Stock B has a beta of

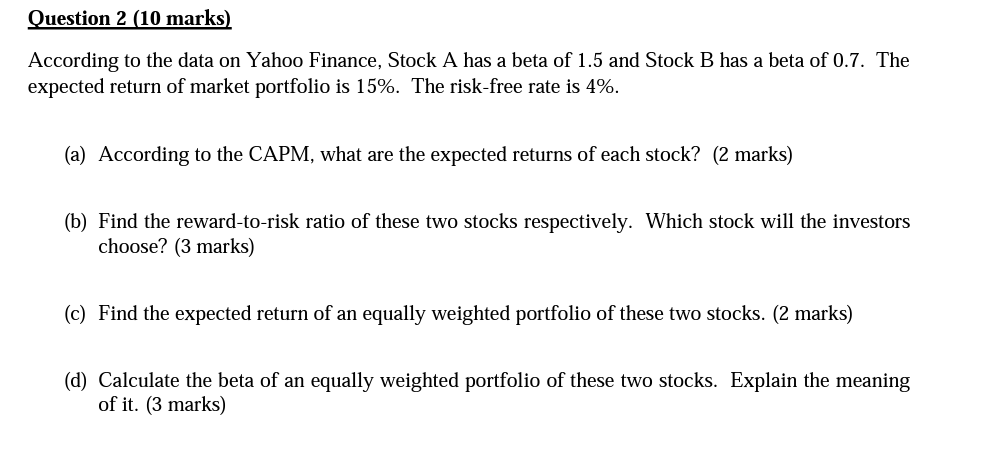

Question 2 (10 marks) According to the data on Yahoo Finance, Stock A has a beta of 1.5 and Stock B has a beta of 0.7. The expected return of market portfolio is 15%. The risk-free rate is 4%. (a) According to the CAPM, what are the expected returns of each stock? (2 marks) (b) Find the reward-to-risk ratio of these two stocks respectively. Which stock will the investors choose? (3 marks) (c) Find the expected return of an equally weighted portfolio of these two stocks. (2 marks) (d) Calculate the beta of an equally weighted portfolio of these two stocks. Explain the meaning of it

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts