Question: QUESTION 2 (10 MARKS) Assume you are a trader with China Bank. From the quote screen on your computer terminal, you notice that Maybank is

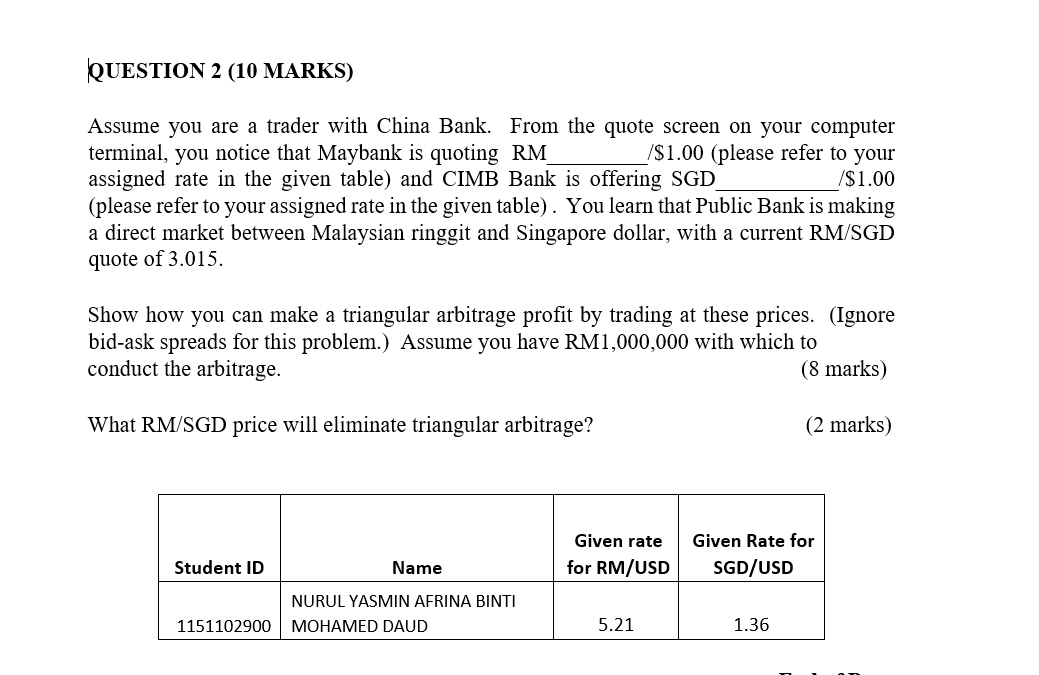

QUESTION 2 (10 MARKS) Assume you are a trader with China Bank. From the quote screen on your computer terminal, you notice that Maybank is quoting RM /$1.00 (please refer to your assigned rate in the given table) and CIMB Bank is offering SGD /$1.00 (please refer to your assigned rate in the given table). You learn that Public Bank is making a direct market between Malaysian ringgit and Singapore dollar, with a current RM/SGD quote of 3.015. Show how you can make a triangular arbitrage profit by trading at these prices. (Ignore bid-ask spreads for this problem.) Assume you have RM1,000,000 with which to conduct the arbitrage. (8 marks) What RM/SGD price will eliminate triangular arbitrage? (2 marks) Given rate for RM/USD Given Rate for SGD/USD Student ID Name NURUL YASMIN AFRINA BINTI MOHAMED DAUD 1151102900 5.21 1.36

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts