Question: Question 2 (10 marks) Consider a stock, the current price (Sc) of which is $30. We model stock-price evolution using a Binomial model. In every

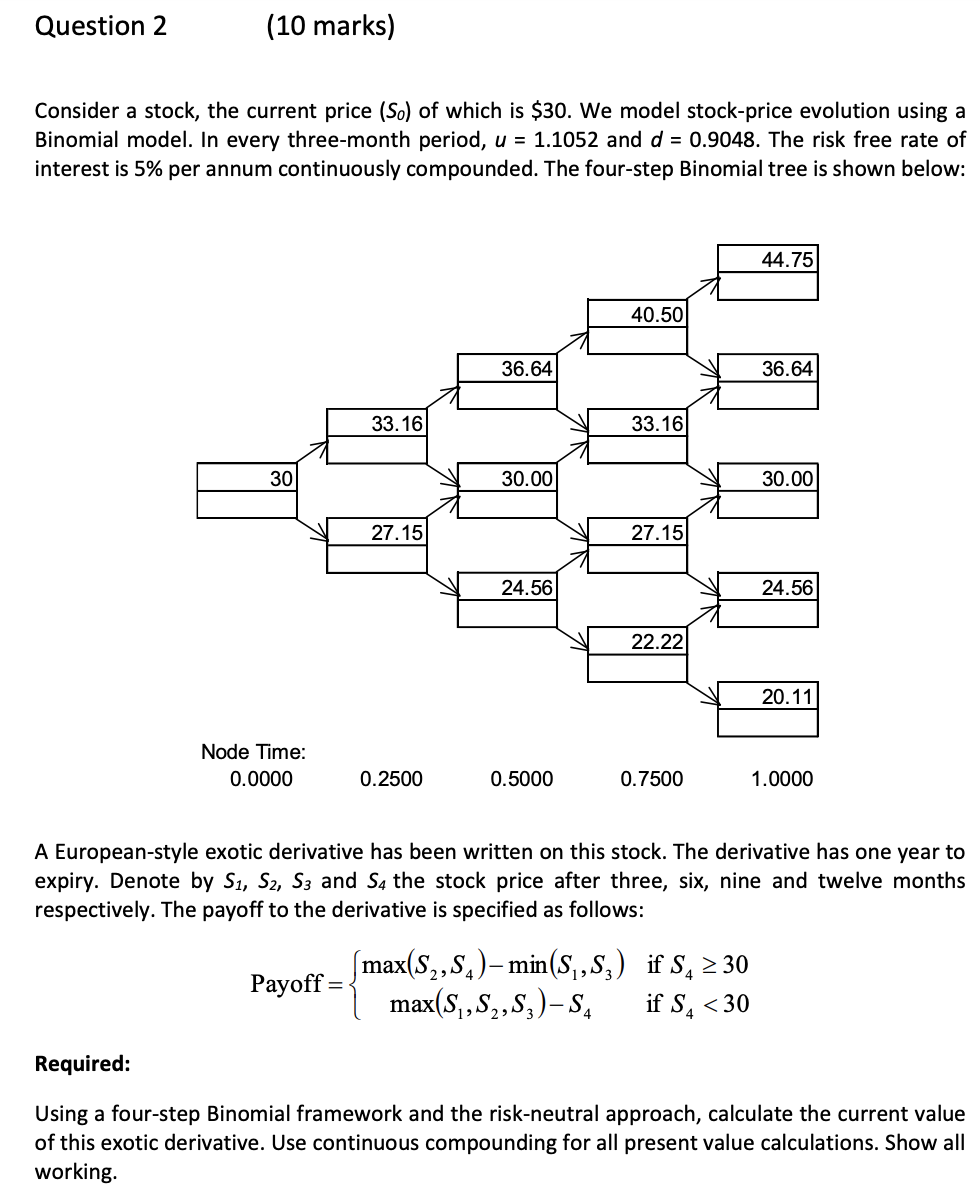

Question 2 (10 marks) Consider a stock, the current price (Sc) of which is $30. We model stock-price evolution using a Binomial model. In every three-month period, u = 1.1052 and d = 0.9048. The risk free rate of interest is 5% per annum continuously compounded. The four-step Binomial tree is shown below: 44.75 40.50 36.64 36.64 33.16 33.16 30 30.00 30.00 27.15 27.15 24.56 24.56 22.22 20.11 Node Time: 0.0000 0.2500 0.5000 0.7500 1.0000 A European-style exotic derivative has been written on this stock. The derivative has one year to expiry. Denote by S1, S2, S3 and 54 the stock price after three, six, nine and twelve months respectively. The payoff to the derivative is specified as follows: (max(S2,S.)- min(S,,S,) if S. 230 Payoff = max(S1,S2,S3)-S. if S.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts