Question: Question 2 (10 marks) Grand Ltd has issued a 3-year bond with a face value of $1000 and which pays a coupon of 6, 10%

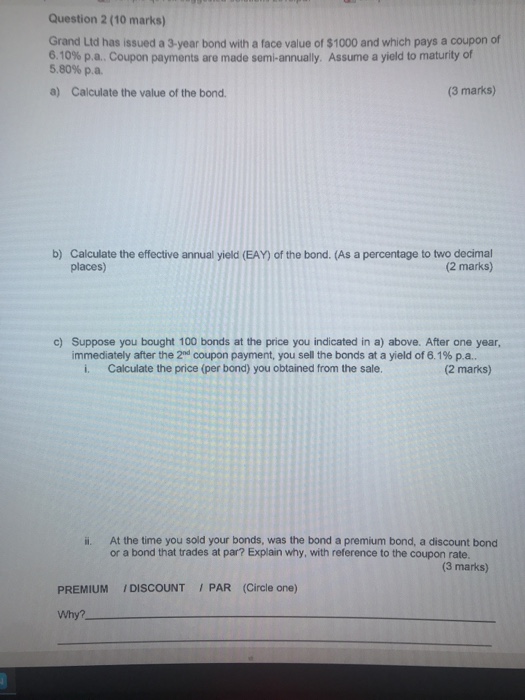

Question 2 (10 marks) Grand Ltd has issued a 3-year bond with a face value of $1000 and which pays a coupon of 6, 10% p.a. Coupon payments are made semi-annually. 5.80% ?.?. Assume a yield to maturity of a) Calculate the value of the bond (3 marks) b) Calculate the effective annual yield (EAY) of the bond. (As a percentage to two decimal (2 marks) places) Suppose you bought 100 bonds at the price you indicated in a) above. After one year, immediately after the 2nd coupon payment, you sell the bonds at a yield of 6.1% pa. c) i. Calculate the price (per bond) you obtained from the sale. (2 marks) i. At the time you sold your bonds, was the bond a premium bond, a discount bond or a bond that trades at par? Explain why, with reference to the coupon rate (3 marks) PREMIUM IDISCOUNT / PAR (Circle one) Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts