Question: Question 2 (10 marks): Lisa just got a VRM (variable rate mortgage) of 200,000 with requirements of monthly payments, a 4-year term and amortization of

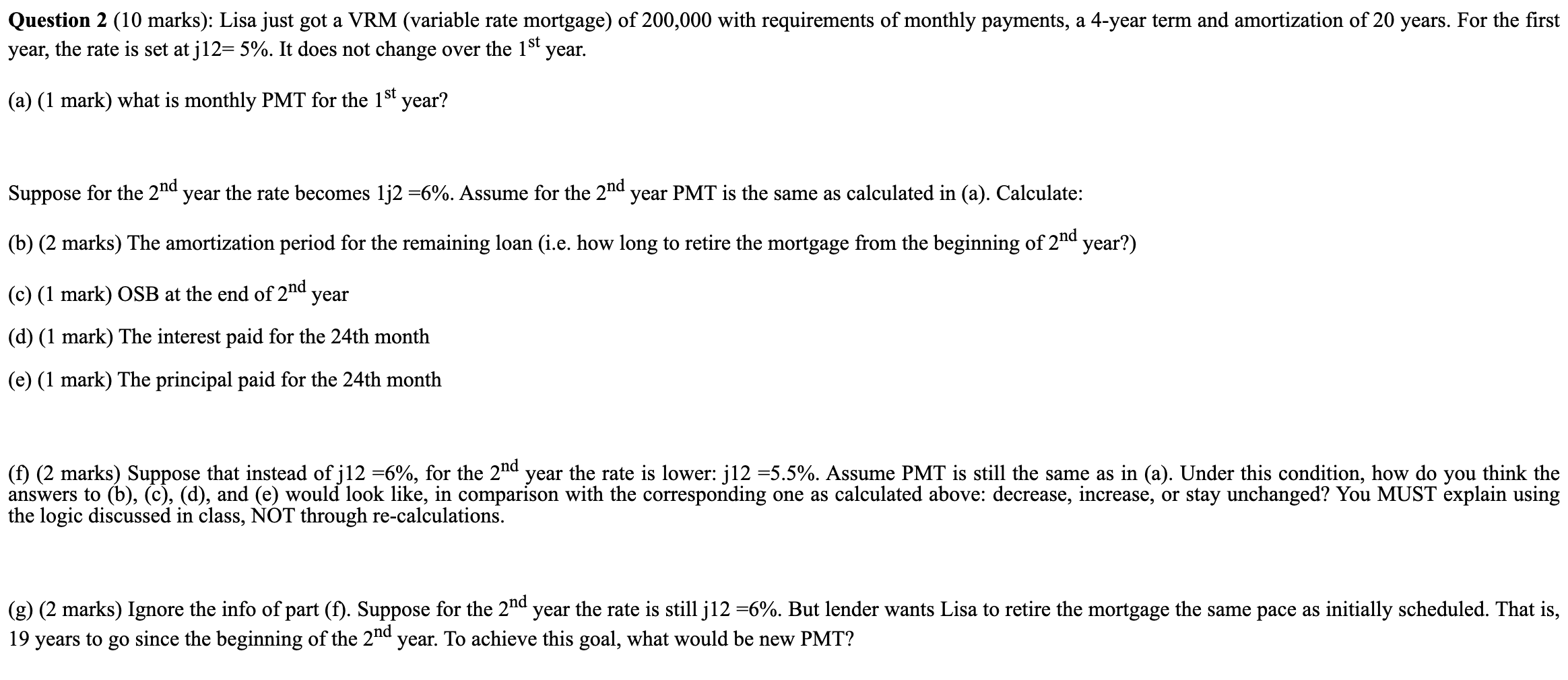

Question 2 (10 marks): Lisa just got a VRM (variable rate mortgage) of 200,000 with requirements of monthly payments, a 4-year term and amortization of 20 years. For the first year, the rate is set at j12= 5%. It does not change over the 1st year. (a) (1 mark) what is monthly PMT for the 1st year? Suppose for the 2nd year the rate becomes 1j2 =6%. Assume for the 2nd year PMT is the same as calculated in (a). Calculate: (b) (2 marks) The amortization period for the remaining loan (i.e. how long to retire the mortgage from the beginning of 2nd year?) (c) (1 mark) OSB at the end of 2nd year (d) (1 mark) The interest paid for the 24th month (e) (1 mark) The principal paid for the 24th month (f) (2 marks) Suppose that instead of j12 =6%, for the 2nd year the rate is lower: j12 =5.5%. Assume PMT is still the same as in (a). Under this condition, how do you think the answers to (b), (c), (d), and (e) would look like, in comparison with the corresponding one as calculated above: decrease, increase, or stay unchanged? You MUST explain using the logic discussed in class, NOT through re-calculations. (g) (2 marks) Ignore the info of part (f). Suppose for the 2nd year the rate is still j12 =6%. But lender wants Lisa to retire the mortgage the same pace as initially scheduled. That is, 19 years to go since the beginning of the 2nd year. To achieve this goal, what would be new PMT? Question 2 (10 marks): Lisa just got a VRM (variable rate mortgage) of 200,000 with requirements of monthly payments, a 4-year term and amortization of 20 years. For the first year, the rate is set at j12= 5%. It does not change over the 1st year. (a) (1 mark) what is monthly PMT for the 1st year? Suppose for the 2nd year the rate becomes 1j2 =6%. Assume for the 2nd year PMT is the same as calculated in (a). Calculate: (b) (2 marks) The amortization period for the remaining loan (i.e. how long to retire the mortgage from the beginning of 2nd year?) (c) (1 mark) OSB at the end of 2nd year (d) (1 mark) The interest paid for the 24th month (e) (1 mark) The principal paid for the 24th month (f) (2 marks) Suppose that instead of j12 =6%, for the 2nd year the rate is lower: j12 =5.5%. Assume PMT is still the same as in (a). Under this condition, how do you think the answers to (b), (c), (d), and (e) would look like, in comparison with the corresponding one as calculated above: decrease, increase, or stay unchanged? You MUST explain using the logic discussed in class, NOT through re-calculations. (g) (2 marks) Ignore the info of part (f). Suppose for the 2nd year the rate is still j12 =6%. But lender wants Lisa to retire the mortgage the same pace as initially scheduled. That is, 19 years to go since the beginning of the 2nd year. To achieve this goal, what would be new PMT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts