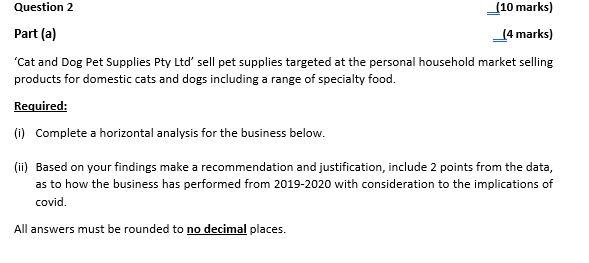

Question: Question 2 (10 marks) Part (a) (4 marks) Cat and Dog Pet Supplies Pty Ltd sell pet supplies targeted at the personal household market selling

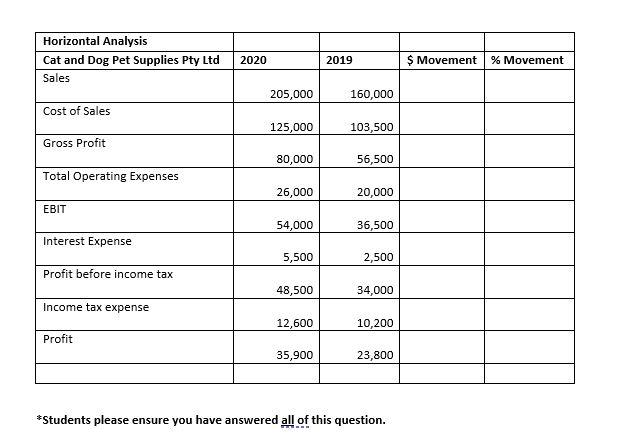

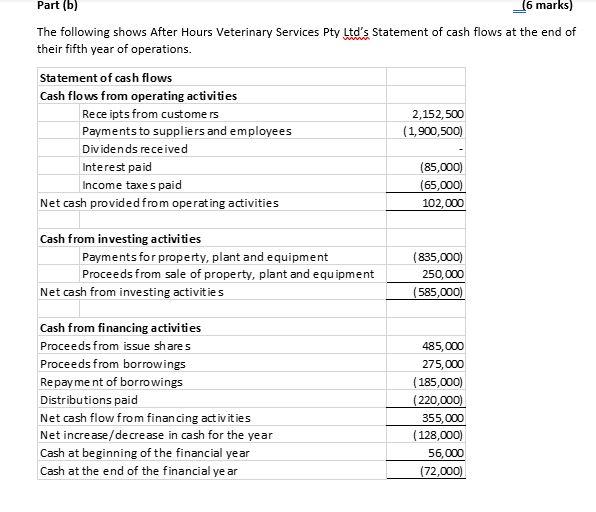

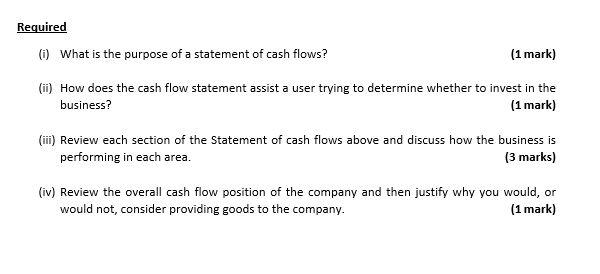

Question 2 (10 marks) Part (a) (4 marks) Cat and Dog Pet Supplies Pty Ltd sell pet supplies targeted at the personal household market selling products for domestic cats and dogs including a range of specialty food. Required: (1) Complete a horizontal analysis for the business below. (ii) Based on your findings make a recommendation and justification, include 2 points from the data, as to how the business has performed from 2019-2020 with consideration to the implications of covid. All answers must be rounded to no decimal places. Horizontal Analysis Cat and Dog Pet Supplies Pty Ltd Sales 2020 2019 $ Movement % Movement 205,000 160,000 Cost of Sales 125,000 103,500 Gross Profit 80,000 56,500 Total Operating Expenses 26,000 20,000 EBIT 54,000 36,500 Interest Expense 5,500 2,500 Profit before income tax 48,500 34,000 Income tax expense 12,600 10,200 Profit 35,900 23,800 *Students please ensure you have answered all of this question. Part (b) (6 marks) The following shows After Hours Veterinary Services Pty Ltd's Statement of cash flows at the end of their fifth year of operations. Statement of cash flows Cash flows from operating activities Receipts from customers Payments to suppliers and employees Dividends received 2,152,500 (1,900,500) Interest paid Income taxes paid Net cash provided from operating activities (85,000) (65,000) 102,000 Cash from investing activities Payments for property, plant and equipment Proceeds from sale of property, plant and equipment Net cash from investing activities (835,000) 250,000 (585,000) Cash from financing activities Proceeds from issue shares Proceeds from borrowings Repayment of borrowings Distributions paid Net cash flow from financing activities Net increase / decrease in cash for the year Cash at beginning of the financial year Cash at the end of the financial year 485,000 275,000 (185,000) (220,000) 355,000 (128,000) 56,000 (72,000) Required (i) What is the purpose of a statement of cash flows? (1 mark) (ii) How does the cash flow statement assist a user trying to determine whether to invest in the business? (1 mark) (iii) Review each section of the Statement of cash flows above and discuss how the business is performing in each area. (3 marks) (iv) Review the overall cash flow position of the company and then justify why you would, or would not consider providing goods to the company. (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts