Question: QUESTION 2 (10 Marks) Sim Lian Ltd acquired a forklift machine for $125,000 on 1 July 2022. It depreciated the asset at 10% p.a. on

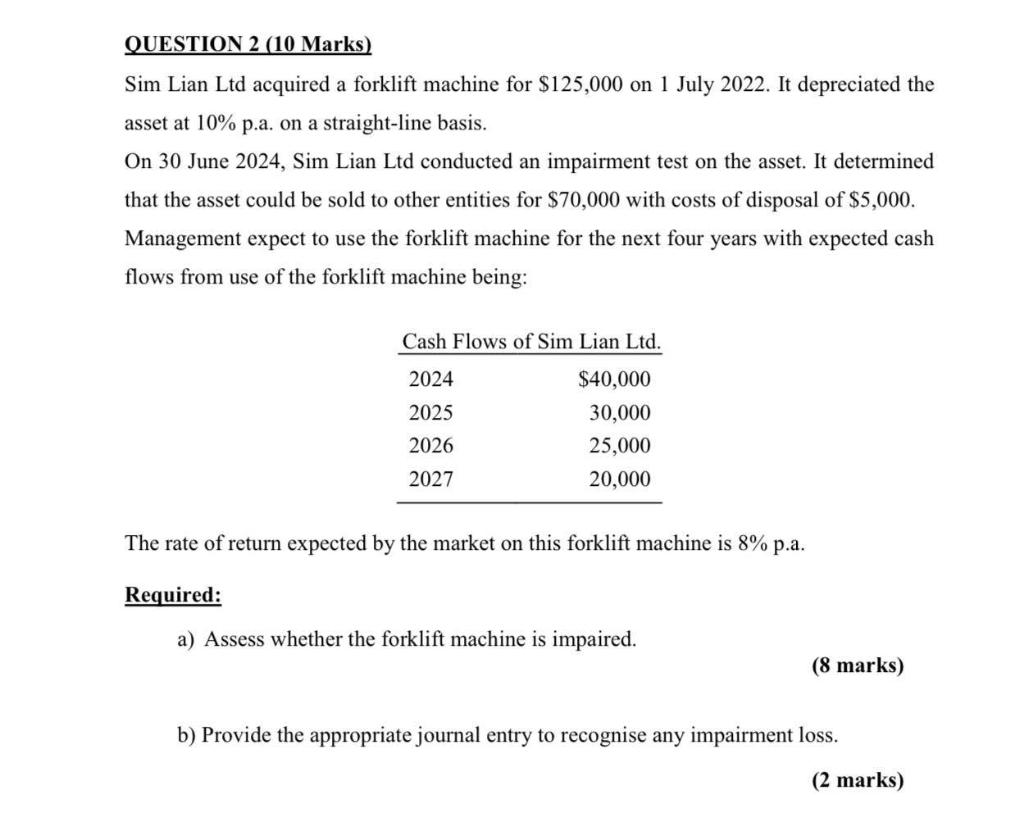

QUESTION 2 (10 Marks) Sim Lian Ltd acquired a forklift machine for $125,000 on 1 July 2022. It depreciated the asset at 10% p.a. on a straight-line basis. On 30 June 2024, Sim Lian Ltd conducted an impairment test on the asset. It determined that the asset could be sold to other entities for $70,000 with costs of disposal of $5,000. Management expect to use the forklift machine for the next four years with expected cash flows from use of the forklift machine being: Cash Flows of Sim Lian Ltd. 2024 2025 2026 $40,000 30,000 25,000 20,000 2027 The rate of return expected by the market on this forklift machine is 8% p.a. Required: a) Assess whether the forklift machine is impaired. (8 marks) b) Provide the appropriate journal entry to recognise any impairment loss. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts