Question: QUESTION 2 (10 MARKS) Theodre Group is a conglomerate located in Europe. Theodre Group is concerned on the depreciation of Euro in the future. The

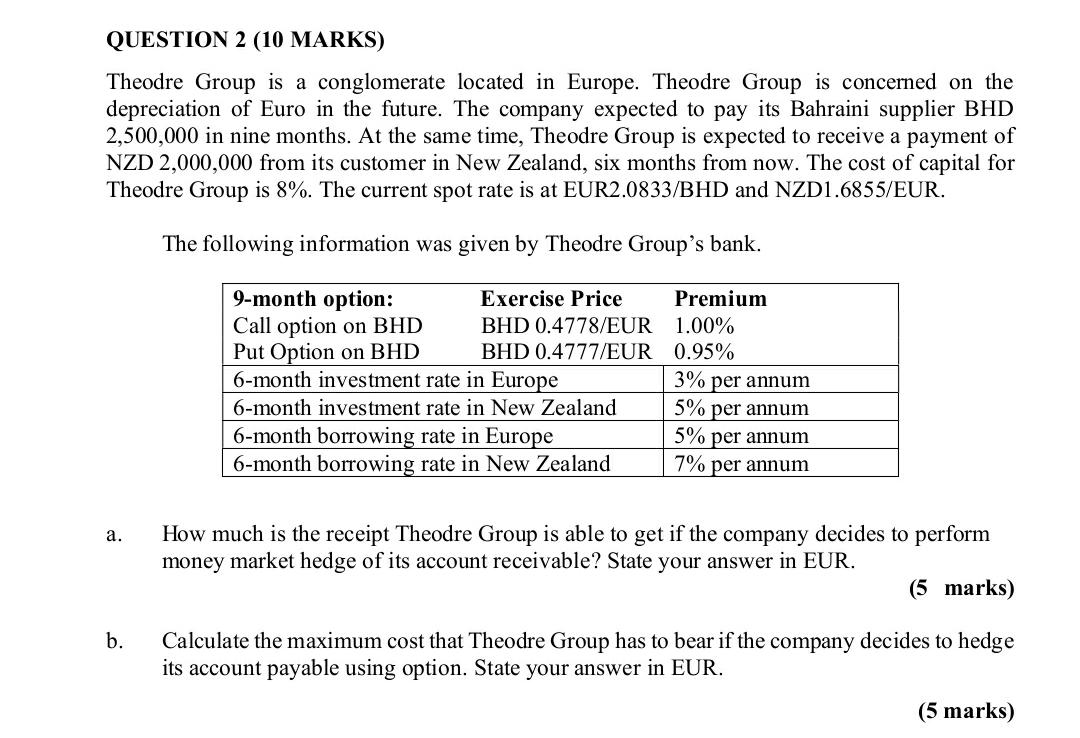

QUESTION 2 (10 MARKS) Theodre Group is a conglomerate located in Europe. Theodre Group is concerned on the depreciation of Euro in the future. The company expected to pay its Bahraini supplier BHD 2,500,000 in nine months. At the same time, Theodre Group is expected to receive a payment of NZD 2,000,000 from its customer in New Zealand, six months from now. The cost of capital for Theodre Group is 8%. The current spot rate is at EUR2.0833/BHD and NZD1.6855/EUR. The following information was given by Theodre Group's bank. 9-month option: Exercise Price Premium Call option on BHD BHD 0.4778/EUR 1.00% Put Option on BHD BHD 0.4777/EUR 0.95% 6-month investment rate in Europe 3% per annum 6-month investment rate in New Zealand 5% per annum 6-month borrowing rate in Europe 5% per annum 6-month borrowing rate New Zealand 7% per annum a. How much is the receipt Theodre Group is able to get if the company decides to perform money market hedge of its account receivable? State your answer in EUR. (5 marks) b. Calculate the maximum cost that Theodre Group has to bear if the company decides to hedge its account payable using option. State your answer in EUR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts