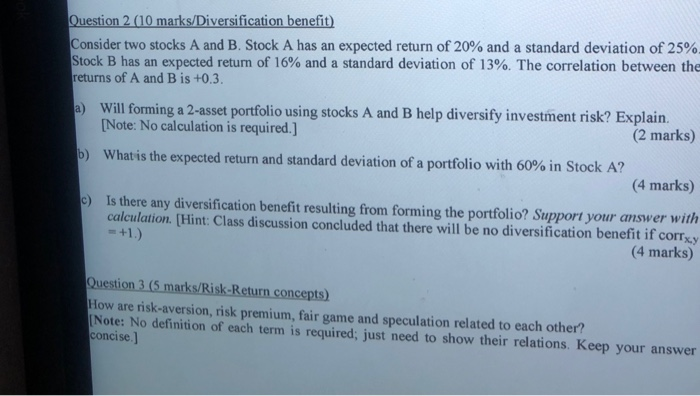

Question: Question 2 (10 marks/Diversification benefit) Consider two stocks A and B. Stock A has an expected return of 20% and a standard deviation of 25%.

Question 2 (10 marks/Diversification benefit) Consider two stocks A and B. Stock A has an expected return of 20% and a standard deviation of 25%. Stock B has an expected return of 16 % and a standard deviation of 13%. The correlation between the returns of A andB is +0.3. a) Will forming a 2-asset portfolio using stocks A and B help diversify investment risk? Explain. [Note: No calculation is required.] (2 marks) b) Whatis the expected return and standard deviation of a portfolio with 60% in Stock A? (4 marks) c) Is there any diversifi cati on benefit resulting from forming the portfolio? Support your answer with calculation. [Hint: Class discussion concluded that there will be no diversification benefit if corr,y -+1.) (4 marks) Question 3 (5 marks/Ri sk-Return concepts) How are risk-aversi on, risk premium, fair game and speculation related to each other? Note: No definition of each term is required; just need to show their relations. Keep your answer concise.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts