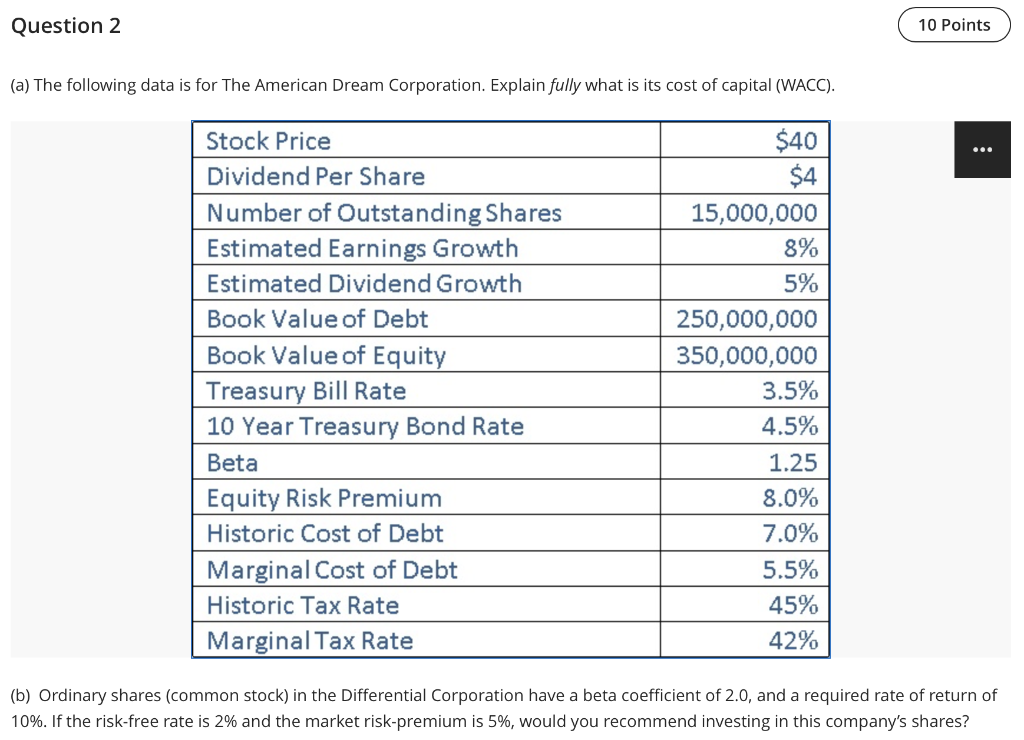

Question: Question 2 10 Points (a) The following data is for The American Dream Corporation. Explain fully what is its cost of capital (WACC). Stock Price

Question 2 10 Points (a) The following data is for The American Dream Corporation. Explain fully what is its cost of capital (WACC). Stock Price Dividend Per Share Number of Outstanding Shares Estimated Earnings Growth Estimated Dividend Growth Book Value of Debt Book Value of Equity Treasury Bill Rate 10 Year Treasury Bond Rate Beta Equity Risk Premium Historic Cost of Debt Marginal Cost of Debt Historic Tax Rate Marginal Tax Rate $40 $4 15,000,000 8% 5% 250,000,000 350,000,000 3.5% 4.5% 1.25 8.0% 7.0% 5.5% 45% 42% (b) Ordinary shares (common stock) in the Differential Corporation have a beta coefficient of 2.0, and a required rate of return of 10%. If the risk-free rate is 2% and the market risk-premium is 5%, would you recommend investing in this company's shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts