Question: Question 2: (10 points) An absorption-costing income statement will report gross margin whereas a variable-costing income statement will report contribution margin. What is the difference

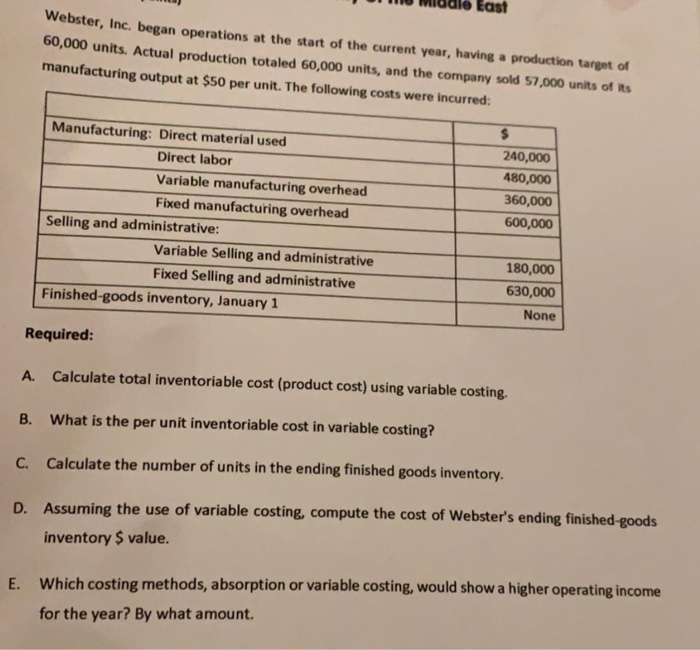

Question 2: (10 points) An absorption-costing income statement will report gross margin whereas a variable-costing income statement will report contribution margin. What is the difference between these terms: gross margin and contribution margin? (Maximum 100 words) East Webster, Inc. began operations at the start of the current year, having a production target of 60,000 units. Actual production totaled 60,000 units, and the company sold 57,000 units of its manufacturing output at $50 per unit. The following costs were incurred: Manufacturing: Direct material used Direct labor Variable manufacturing overhead Fixed manufacturing overhead Selling and administrative: Variable Selling and administrative Fixed Selling and administrative Finished-goods inventory, January 1 $ 240,000 480,000 360,000 600,000 180,000 630,000 None Required: A. Calculate total inventoriable cost (product cost) using variable costing. B. What is the per unit inventoriable cost in variable costing? C. Calculate the number of units in the ending finished goods inventory. D. Assuming the use of variable costing, compute the cost of Webster's ending finished-goods inventory $ value. E. Which costing methods, absorption or variable costing, would show a higher operating income for the year? By what amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts