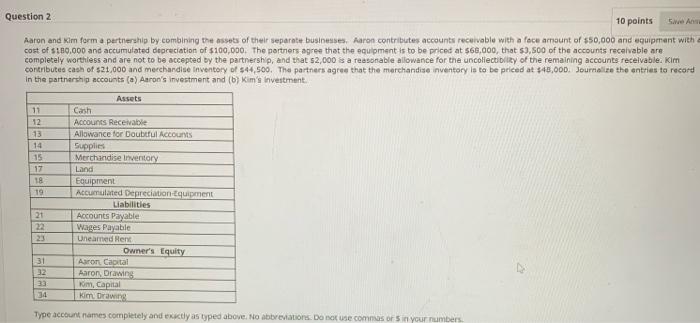

Question: Question 2 10 points Save Answ Aaron and Kim form a partnership by combining the assets of their separate businesses. Aaron contributes accounts receivable

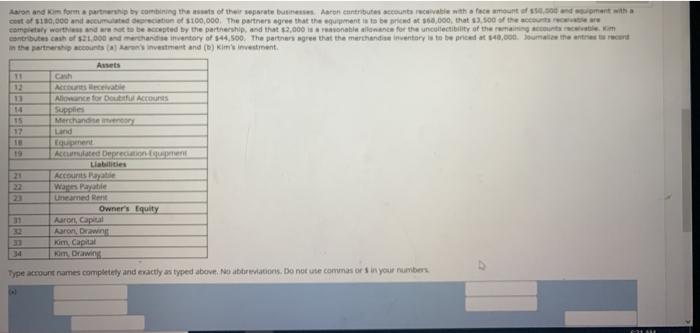

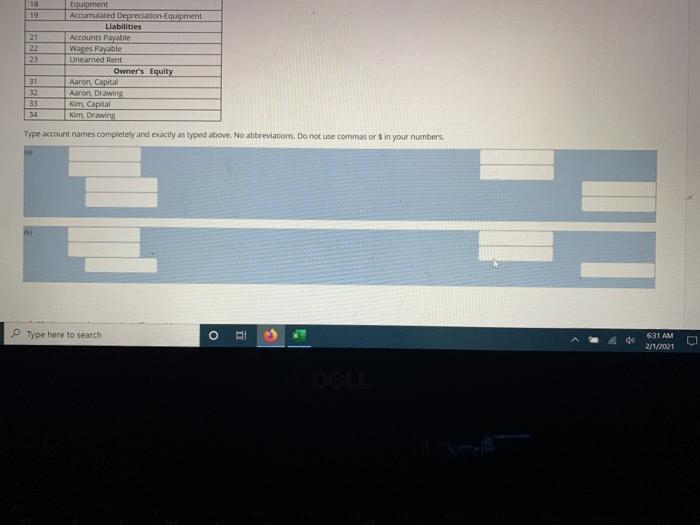

Question 2 10 points Save Answ Aaron and Kim form a partnership by combining the assets of their separate businesses. Aaron contributes accounts receivable with a face amount of $50,000 and equipment with a cost of $180,000 and accumulated depreciation of $100,000. The partners agree that the equipment is to be priced at $68,000, that $3,500 of the accounts receivable are completely worthless and are not to be accepted by the partnership, and that $2,000 is a reasonable allowance for the uncollectibility of the remaining accounts receivable. Kim contributes cash of $21,000 and merchandise Inventory of $44,500. The partners agree that the merchandise inventory is to be priced at $48,000. Journalize the entries to record In the partnership accounts (a) Aaron's investment and (b) Kim's investment. Accounts Receivable Allowance for Doubtful Accounts Assets 11 Cash 12 13 14 15 17 Land 18 19 Supplies Merchandise Inventory Equipment Accumulated Depreciation-Equipment Liabilities Accounts Payable 21 22 Wages Payable 231 Unearned Rent Owner's Equity 31 Aaron Capital 32 Aaron, Drawing 33 34 Kim, Capital Kim Drawing Type account names completely and exactly as typed above. No abbreviations. Do not use commas or 5 in your numbers Aaron and Kim form a partnership by combining the assets of their separate businesses. Aaron contributes accounts receivable with a face amount of $50,000 and equipment with a cost of $180,000 and accumulated depreciation of $100,000. The partners agree that the equipment is to be priced at $60,000, that $3,500 of the accounts receivable are completely worthless and are not to be accepted by the partnership, and that $2,000 is a reasonable allowance for the uncollectibility of the remaining accounts receivable im contributes cash of $21,000 and merchandise inventory of $44,500. The partners agree that the merchandise inventory is to be priced at $40,000. Journalize the entries to record in the partnership accounts (a) Aaran's investment and (b) Kim's investment. 11 Cash Assets 12 Accounts Receivable Allowance for Doubtful Accounts Supplies Merchandise inventory 13 14 15 17 Land 10 19 Equipment Accumulated Deprecation Equipment Liabilities Accounts Payable 21 22 Wages Payable 23 Unearned Rent Owner's Equity 31 Aaron, Capital 32 Aaron, Drawing 33 Kim, Capital 34 Kim, Drawing Type account names completely and exactly as typed above. No abbreviations. Do not use commas or $ in your numbers 18 19 Equipment Accumulated Depreciation-Equipment Liabilities Accounts Payable 21 22 Wages Payable 23 Unearned Rent Owner's Equity Aaron, Capital Aaron, Drawing Type account names completely and exactly as typed above. No abbreviations. Do not use commas or $ in your numbers. 31 32 33 341 Kim, Capital Kim, Drawing Type here to search O TE F DELL 631 AM 2/1/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts