Question: Question 2 (10 points) Suppose, as a junior financial analyst, your employer is considering two mutually exclusive projects, A and B, with the anticipated net

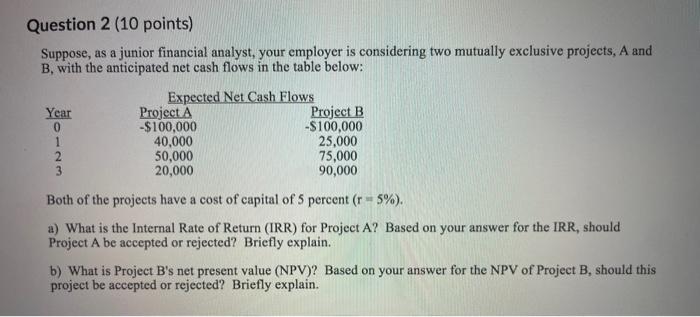

Question 2 (10 points) Suppose, as a junior financial analyst, your employer is considering two mutually exclusive projects, A and B, with the anticipated net cash flows in the table below: Year 0 1 2 3 Expected Net Cash Flows Project A Project B -$100,000 -$100,000 40,000 25,000 50,000 75,000 20,000 90,000 Both of the projects have a cost of capital of 5 percent (r = 5%). a) What is the Internal Rate of Return (IRR) for Project A? Based on your answer for the IRR, should Project A be accepted or rejected? Briefly explain. b) What is Project B's net present value (NPV)? Based on your answer for the NPV of Project B, should this project be accepted or rejected? Briefly explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts