Question: Question 2 (10 points) The following are the estimates generated by security analyst, and these are the only stocks in the country, Rf is 5

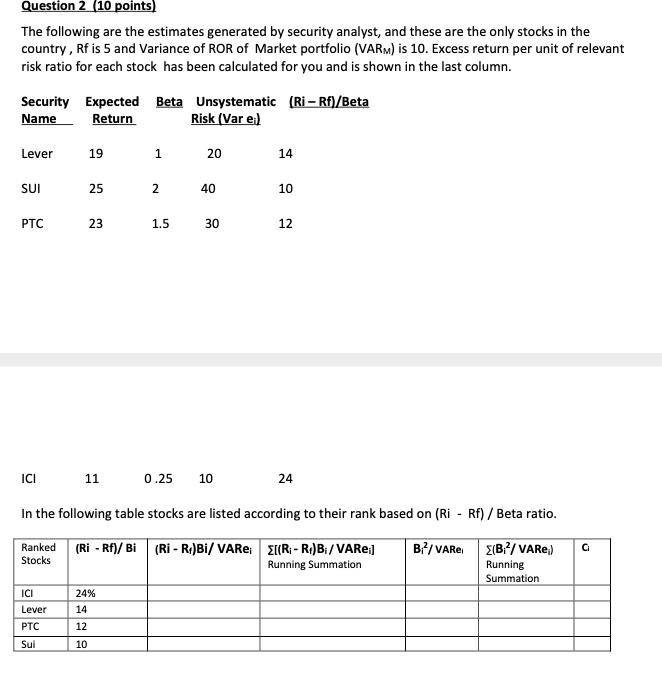

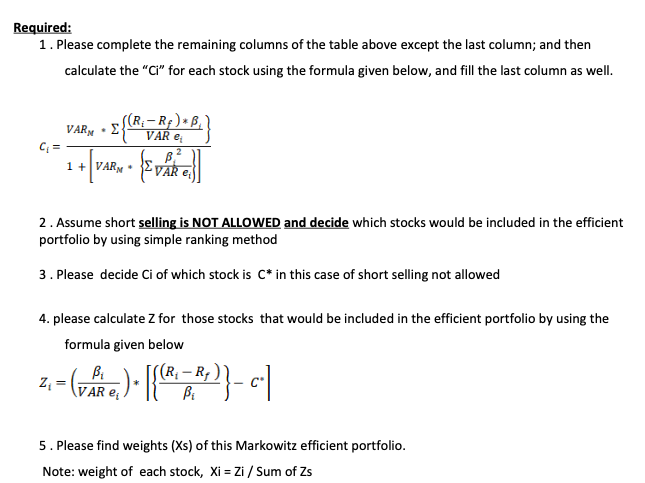

Question 2 (10 points) The following are the estimates generated by security analyst, and these are the only stocks in the country, Rf is 5 and Variance of ROR of Market portfolio (VARM) is 10. Excess return per unit of relevant risk ratio for each stock has been calculated for you and is shown in the last column. Security Expected Beta Unsystematic (Ri - Rf)/Beta Name Return Risk (Var ei) Lever 19 1 20 14 SUI 25 40 10 N PTC 23 1.5 30 12 ICI 11 0.25 10 24 In the following table stocks are listed according to their rank based on (Ri - Rf) / Beta ratio. Ranked Stocks (Ri - Rf)/ Bi (Ri - Rr)Bi/ VARe: [(R:- R)B:/VARe:] Running Summation BP/VARE (B?/ VARE) Running Summation ICI Lever PTC 24% 14 12 Sui 10 Required: 1. Please complete the remaining columns of the table above except the last column; and then calculate the "Ci for each stock using the formula given below, and fill the last column as well. VARE {(R;- Rp)*B C = VAR B VAR 1 + VARN 2. Assume short selling is NOT ALLOWED and decide which stocks would be included in the efficient portfolio by using simple ranking method 3. Please decide Ci of which stock is c* in this case of short selling not allowed 4. please calculate Z for those stocks that would be included in the efficient portfolio by using the formula given below B. (R-R Z = (vaikea)f{@P}}-c1 5. Please find weights (Xs) of this Markowitz efficient portfolio. Note: weight of each stock, Xi = Zi / Sum of Zs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts