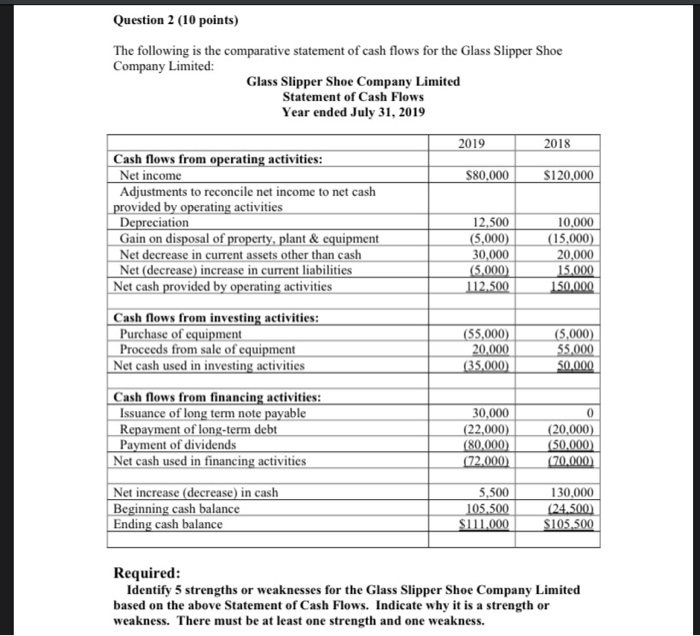

Question: Question 2 (10 points) The following is the comparative statement of cash flows for the Glass Slipper Shoe Company Limited: Glass Slipper Shoe Company Limited

Question 2 (10 points) The following is the comparative statement of cash flows for the Glass Slipper Shoe Company Limited: Glass Slipper Shoe Company Limited Statement of Cash Flows Year ended July 31, 2019 2019 2018 $80,000 $120,000 Cash flows from operating activities: Net income Adjustments to reconcile net income to net cash provided by operating activities Depreciation Gain on disposal of property, plant & equipment Net decrease in current assets other than cash Net (decrease) increase in current liabilities Net cash provided by operating activities 12,500 (5,000) 30,000 (5,000) 112.500 10,000 (15,000) 20,000 15,000 150,000 Cash flows from investing activities: Purchase of equipment Proceeds from sale of equipment Net cash used in investing activities (55,000) 20,000 (35.000 (5,000) 55,000 50.000 0 Cash flows from financing activities: Issuance of long term note payable Repayment of long-term debt Payment of dividends Net cash used in financing activities 30,000 (22,000) (80.000 (72.000 (20,000) (50.000 (70.000 Net increase (decrease) in cash Beginning cash balance Ending cash balance 5,500 105,500 $111.000 130,000 (24.500) $105,500 Required: Identify 5 strengths or weaknesses for the Glass Slipper Shoe Company Limited based on the above Statement of Cash Flows. Indicate why it is a strength or weakness. There must be at least one strength and one weakness

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts