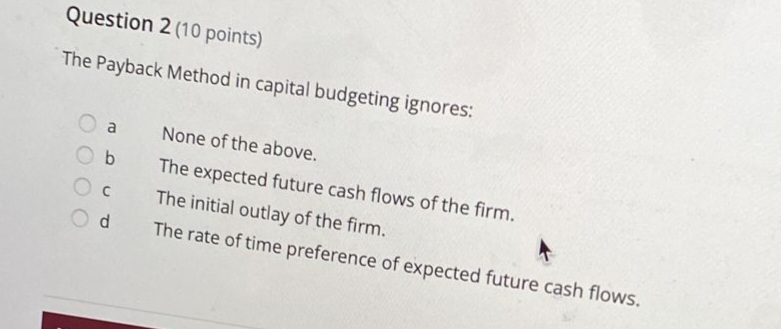

Question: Question 2 (10 points) The Payback Method in capital budgeting ignores: O a None of the above. Ob The expected future cash flows of the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts