Question: Question 2 --/10 View Policies Current Attempt in Progress Blue Manufacturing (BM) has a December 31 year end. On July 1, 2019, BM made extensive

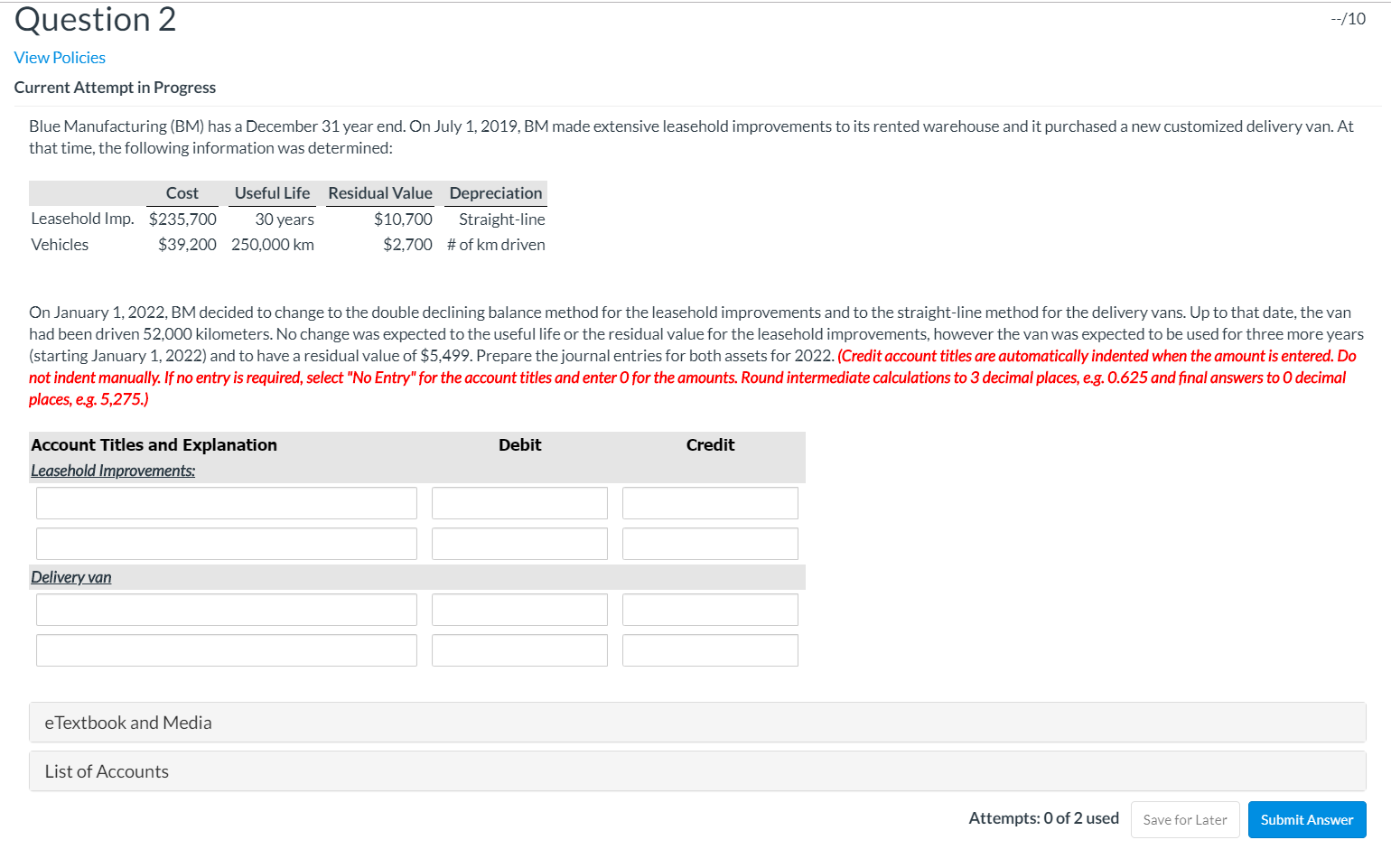

Question 2 --/10 View Policies Current Attempt in Progress Blue Manufacturing (BM) has a December 31 year end. On July 1, 2019, BM made extensive leasehold improvements to its rented warehouse and it purchased a new customized delivery van. At that time, the following information was determined: Cost Useful Life Residual Value Depreciation Leasehold Imp. $235,700 30 years $10,700 Straight-line Vehicles $39,200 250,000 km $2,700 # of km driven On January 1, 2022, BM decided to change to the double declining balance method for the leasehold improvements and to the straight-line method for the delivery vans. Up to that date, the van had been driven 52,000 kilometers. No change was expected to the useful life or the residual value for the leasehold improvements, however the van was expected to be used for three more years (starting January 1, 2022) and to have a residual value of $5,499. Prepare the journal entries for both assets for 2022. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round intermediate calculations to 3 decimal places, e.g. 0.625 and final answers to O decimal places, e.g. 5,275.) Debit Credit Account Titles and Explanation Leasehold Improvements: Delivery van e Textbook and Media List of Accounts Attempts: 0 of 2 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts