Question: QUESTION 2 (100 marks in total) 1. Suppose that a trader has bought two shares AB and CD. In particular, she has x (000s) shares

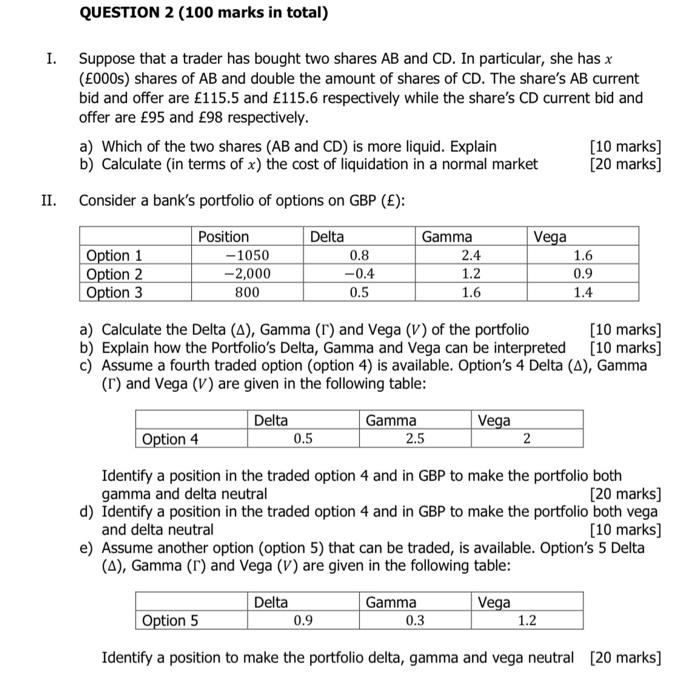

QUESTION 2 (100 marks in total) 1. Suppose that a trader has bought two shares AB and CD. In particular, she has x (000s) shares of AB and double the amount of shares of CD. The share's AB current bid and offer are 115.5 and 115.6 respectively while the share's CD current bid and offer are 95 and 98 respectively. a) Which of the two shares (AB and CD) is more liquid. Explain [10 marks] b) Calculate (in terms of x) the cost of liquidation in a normal market [20 marks] II. Consider a bank's portfolio of options on GBP (): Option 1 Option 2 Option 3 Position -1050 -2,000 800 Delta 0.8 -0.4 0.5 Gamma 2.4 1.2 1.6 Vega 1.6 0.9 1.4 a) Calculate the Delta (A), Gamma () and Vega (V) of the portfolio [10 marks] b) Explain how the Portfolio's Delta, Gamma and Vega can be interpreted [10 marks] c) Assume a fourth traded option (option 4) is available. Option's 4 Delta (A), Gamma (T) and Vega (V) are given in the following table: Delta Gamma Vega Option 4 0.5 2.5 2 Identify a position in the traded option 4 and in GBP to make the portfolio both gamma and delta neutral [20 marks] d) Identify a position in the traded option 4 and in GBP to make the portfolio both vega and delta neutral (10 marks] e) Assume another option (option 5) that can be traded, is available. Option's 5 Delta (A), Gamma () and Vega (V) are given in the following table: Option 5 Delta 0.9 Gamma 0.3 Vega 1.2 Identify a position to make the portfolio delta, gamma and vega neutral [20 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts