Question: Question 2 (12 marks) Read the information below and answer the question that follows: A buy-side analyst analyses two companies, Company B and Company C,

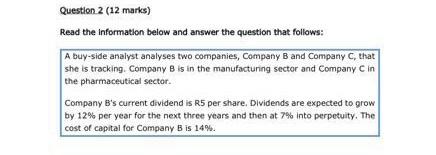

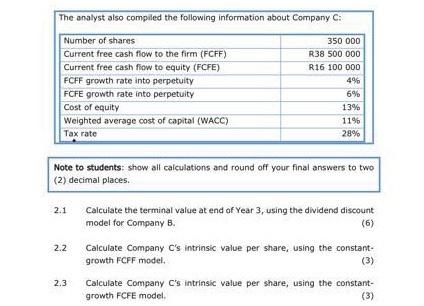

Question 2 (12 marks) Read the information below and answer the question that follows: A buy-side analyst analyses two companies, Company B and Company C, that she is tracking Company B is in the manufacturing sector and Company C in the pharmaceutical sector. Company B's current dividend is R5 per share. Dividends are expected to grow by 12% per year for the next three years and then at 7% Into perpetuity. The cost of capital for Company B is 14% The analyst also compiled the following information about Company C: 350 ODO R38 500 000 R16 100 000 4% Number of shares Current free cash flow to the firm (FCFF) Current free cash flow to equity (FCFE) FCFF growth rate into perpetuity FCFE growth rate into perpetuity Cost of equity Weighted average cost of capital (WACC) Tax rate 6% 13% 11% 28% Note to students: show all calculations and round off your final answers to two (2) decimal places. 2.1 Calculate the terminal value at end of Year 3, using the dividend discount model for Company B. (6) 2.2 Calculate Company C's intrinsic value per share, using the constant- growth FCFF model. (3) 2.3 Calculate Company C's intrinsic value per share, using the constant- growth FCFE model. (3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts