Question: Question 2 (12 marks total) Rocky Volcano Chocolate operates two stores, one in Edmonton and another in St. John's. The following income statements were prepared

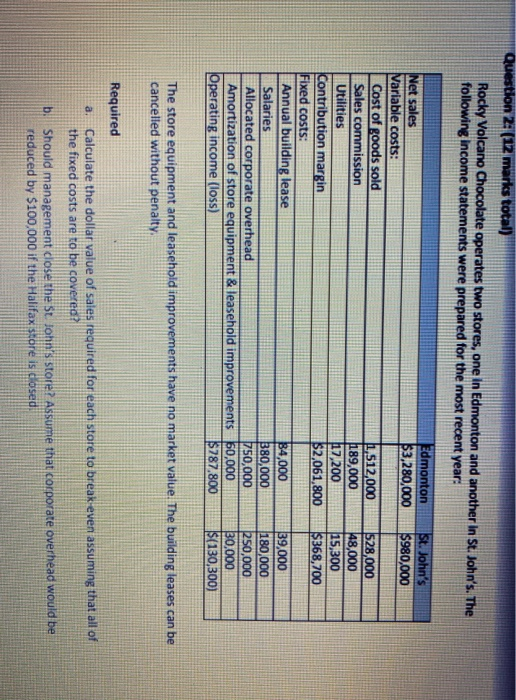

Question 2 (12 marks total) Rocky Volcano Chocolate operates two stores, one in Edmonton and another in St. John's. The following income statements were prepared for the most recent year: St. John's $980,000 Edmonton Net sales $3,280,000 Variable costs: Cost of goods sold 1.512,000 Sales commission 189,000 Utilities 17,200 Contribution margin $2,061,800 Fixed costs: Annual building lease B4,000 Salaries 380,000 Allocated corporate overhead 750,000 Amortization of store equipment & leasehold improvements 50,000 Operating income (loss) $787.800 528,000 48,000 15,300 $368,700 39,000 180,000 1250,000 30,000 $(130,300) The store equipment and leasehold improvements have no market value. The building leases can be cancelled without penalty. Required a. Calculate the dollar value of sales required for each store to break even assuming that all of the fixed costs are to be covered? b. Should management close the St. John's store? Assume that corporate overhead would be reduced by $100,000 if the Halifax store is closed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts