Question: Question 2: 14 marks Jordan Corp.'s transactions for the year ended December 31, 2019 included the following: Purchased real estate for $550,000 cash which was

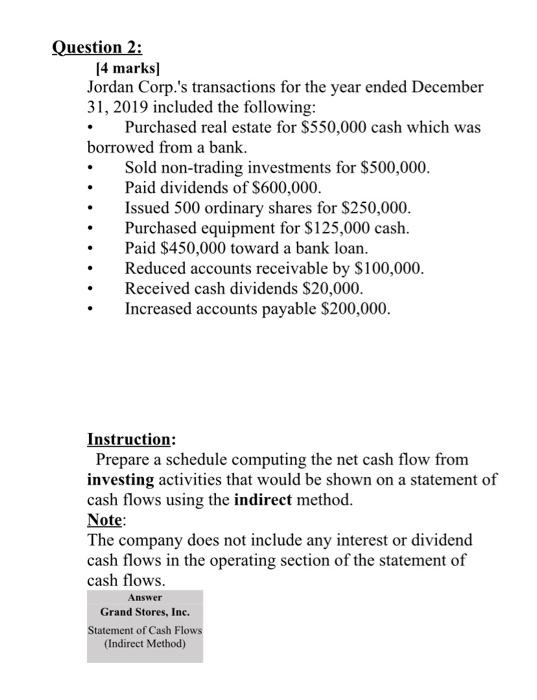

Question 2: 14 marks Jordan Corp.'s transactions for the year ended December 31, 2019 included the following: Purchased real estate for $550,000 cash which was borrowed from a bank. Sold non-trading investments for $500,000. Paid dividends of $600,000. Issued 500 ordinary shares for $250,000. Purchased equipment for $125,000 cash. Paid $450,000 toward a bank loan. Reduced accounts receivable by $100,000. Received cash dividends $20,000. Increased accounts payable $200,000. . Instruction: Prepare a schedule computing the net cash flow from investing activities that would be shown on a statement of cash flows using the indirect method. Note: The company does not include any interest or dividend cash flows in the operating section of the statement of cash flows. Answer Grand Stores, Inc. Statement of Cash Flows (Indirect Method)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts