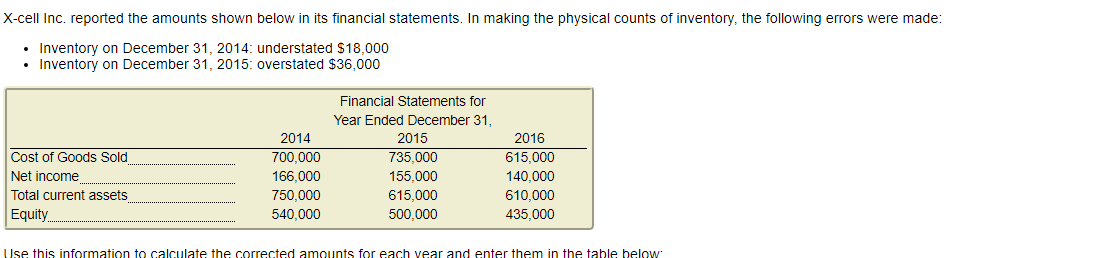

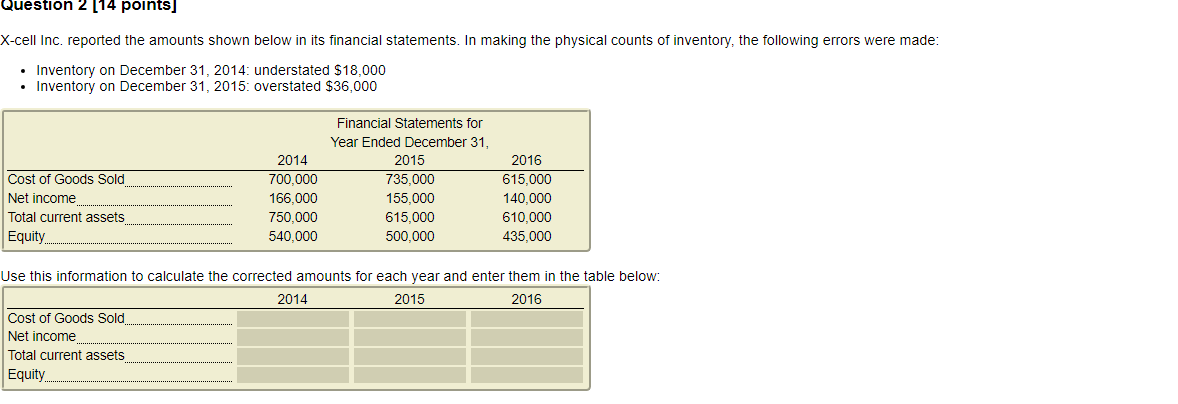

Question: Question 2 [14 points] X-cell Inc. reported the amounts shown below in its financial statements. In making the physical counts of inventory, the following errors

![Question 2 [14 points] X-cell Inc. reported the amounts shown below](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e8902318afc_28266e89022a9373.jpg)

Question 2 [14 points] X-cell Inc. reported the amounts shown below in its financial statements. In making the physical counts of inventory, the following errors were made: Inventory on December 31, 2014: understated $18,000 Inventory on December 31, 2015: overstated $36,000 Cost of Goods Sold Net income Total current assets Equity 2014 700,000 166,000 750,000 540,000 Financial Statements for Year Ended December 31, 2015 735,000 155,000 615,000 500,000 2016 615,000 140,000 610,000 435,000 Use this information to calculate the corrected amounts for each year and enter them in the table below: 2014 2015 2016 Cost of Goods Sold Net income Total current assets Equity. X-cell Inc. reported the amounts shown below in its financial statements. In making the physical counts of inventory, the following errors were made: Inventory on December 31, 2014: understated $18,000 Inventory on December 31, 2015: overstated $36,000 Cost of Goods Sold Net income Total current assets Equity. 2014 700,000 166,000 750,000 540,000 Financial Statements for Year Ended December 31, 2015 735,000 155,000 615,000 500,000 2016 615,000 140,000 610,000 435,000 Use this information to calculate the corrected amounts for each vear and enter them in the table below Question 2 [14 points] X-cell Inc. reported the amounts shown below in its financial statements. In making the physical counts of inventory, the following errors were made: Inventory on December 31, 2014: understated $18,000 Inventory on December 31, 2015: overstated $36,000 2016 Cost of Goods Sold Net income Total current assets Equity 2014 700,000 166.000 750,000 540,000 Financial Statements for Year Ended December 31, 2015 735,000 155,000 615,000 500,000 615,000 140,000 610.000 435,000 Use this information to calculate the corrected amounts for each year and enter them in the table below: 2014 2015 2016 Cost of Goods Sold Net income Total current assets Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts