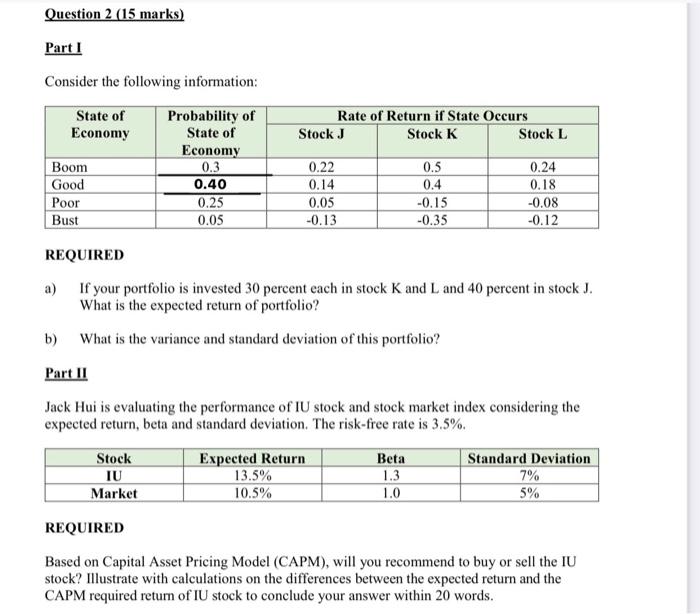

Question: Question 2 (15 marks) Part 1 Consider the following information: State of Probability of Economy State of Economy Boom 0.3 Good 0.40 Poor 0.25 Bust

Question 2 (15 marks) Part 1 Consider the following information: State of Probability of Economy State of Economy Boom 0.3 Good 0.40 Poor 0.25 Bust 0.05 Rate of Return if State Occurs Stock J Stock K Stock L 0.22 0.14 0.05 -0.13 0.5 0.4 -0.15 -0.35 0.24 0.18 -0.08 -0.12 REQUIRED a) If your portfolio is invested 30 percent each in stock K and L and 40 percent in stock J. What is the expected return of portfolio? b) What is the variance and standard deviation of this portfolio? Part II Jack Hui is evaluating the performance of IU stock and stock market index considering the expected return, beta and standard deviation. The risk-free rate is 3.5%. Stock Expected Return Beta Standard Deviation IU 13.5% 1.3 7% Market 10.5% 1.0 5% REQUIRED Based on Capital Asset Pricing Model (CAPM), will you recommend to buy or sell the IU stock? Illustrate with calculations on the differences between the expected return and the CAPM required return of IU stock to conclude your answer within 20 words

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts