Question: Question 2 (15 marks) Part 2A As at 31 December 2020, accounts receivable amounted to $49,000 (being gross amounts of $50,000, net of allowance

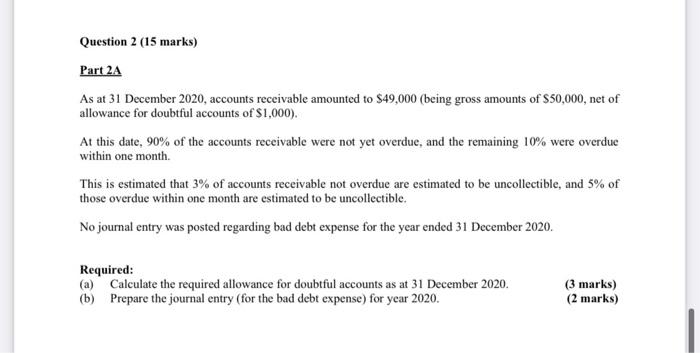

Question 2 (15 marks) Part 2A As at 31 December 2020, accounts receivable amounted to $49,000 (being gross amounts of $50,000, net of allowance for doubtful accounts of $1,000). At this date, 90% of the accounts receivable were not yet overdue, and the remaining 10% were overdue within one month. This is estimated that 3% of accounts receivable not overdue are estimated to be uncollectible, and 5% of those overdue within one month are estimated to be uncollectible. No journal entry was posted regarding bad debt expense for the year ended 31 December 2020. Required: (a) Calculate the required allowance for doubtful accounts as at 31 December 2020. (b) Prepare the journal entry (for the bad debt expense) for year 2020. (3 marks) (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts