Question: Question 2 (15 Marks) Part A (10 Marks) CSL Ltd is calculating one of its employee benefits liabilities. Justin Lachal is one of the lab

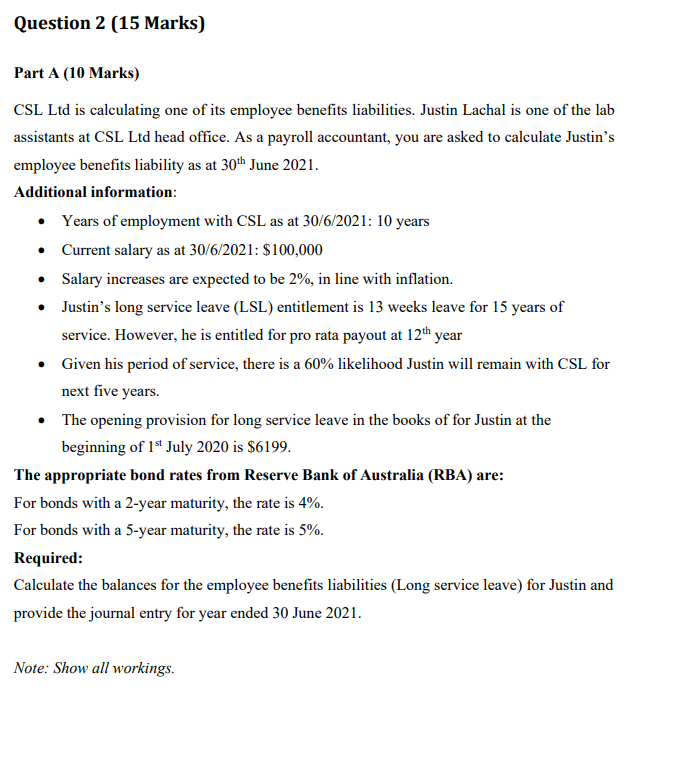

Question 2 (15 Marks) Part A (10 Marks) CSL Ltd is calculating one of its employee benefits liabilities. Justin Lachal is one of the lab assistants at CSL Ltd head office. As a payroll accountant, you are asked to calculate Justin's employee benefits liability as at 30th June 2021. Additional information: Years of employment with CSL as at 30/6/2021: 10 years Current salary as at 30/6/2021: $100,000 Salary increases are expected to be 2%, in line with inflation. Justin's long service leave (LSL) entitlement is 13 weeks leave for 15 years of service. However, he is entitled for pro rata payout at 12th year Given his period of service, there is a 60% likelihood Justin will remain with CSL for next five years. The opening provision for long service leave in the books of for Justin at the beginning of 1st July 2020 is $6199. The appropriate bond rates from Reserve Bank of Australia (RBA) are: For bonds with a 2-year maturity, the rate is 4%. For bonds with a 5-year maturity, the rate is 5%. Required: Calculate the balances for the employee benefits liabilities (Long service leave) for Justin and provide the journal entry for year ended 30 June 2021. Note: Show all workings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts