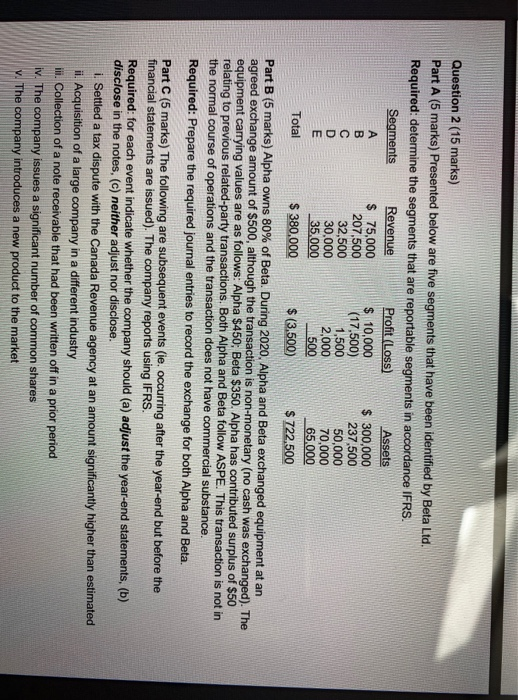

Question: Question 2 (15 marks) Part A (5 marks) Presented below are five segments that have been identified by Beta Ltd. Required: determine the segments that

Question 2 (15 marks) Part A (5 marks) Presented below are five segments that have been identified by Beta Ltd. Required: determine the segments that are reportable segments in accordance IFRS. Segments Revenue Profit (Loss) Assets $ 75,000 $ 10,000 $ 300,000 207,500 (17,500) 237,500 32,500 1,500 50,000 30.000 2,000 70,000 35,000 500 65,000 Total $ 380,000 $ (3,500) $ 722,500 Part B (5 marks) Alpha owns 80% of Beta. During 2020, Alpha and Beta exchanged equipment at an agreed exchange amount of $500, although the transaction is non-monetary (no cash was exchanged). The equipment carrying values are as follows: Alpha $450: Beta $350. Alpha has contributed surplus of $50 relating to previous related-party transactions. Both Alpha and Beta follow ASPE. This transaction is not in the normal course of operations and the transaction does not have commercial substance. Required: Prepare the required journal entries to record the exchange for both Alpha and Beta. mo Part C (5 marks) The following are subsequent events (ie. occurring after the year-end but before the financial statements are issued). The company reports using IFRS. Required: for each event indicate whether the company should (a) adjust the year-end statements. (b) disclose in the notes, (c) neither adjust nor disclose. 1. Settled a tax dispute with the Canada Revenue agency at an amount significantly higher than estimated ii. Acquisition of a large company in a different industry ill. Collection of a note receivable that had been written off in a prior period iv. The company issues a significant number of common shares V. The company introduces a new product to the market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts