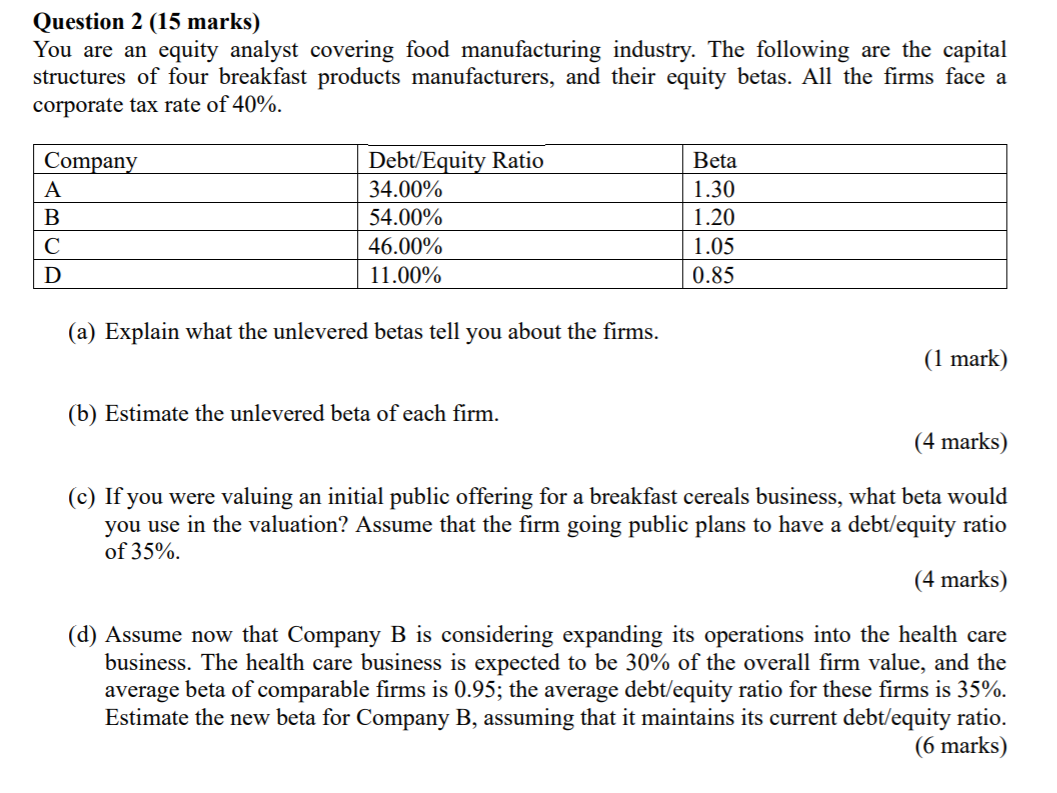

Question: Question 2 (15 marks) You are an equity analyst covering food manufacturing industry. The following are the capital structures of four breakfast products manufacturers, and

Question 2 (15 marks) You are an equity analyst covering food manufacturing industry. The following are the capital structures of four breakfast products manufacturers, and their equity betas. All the firms face a corporate tax rate of 40%. Company B C Debt/Equity Ratio 34.00% 54.00% 46.00% 11.00% Beta 1.30 1.20 1.05 0.85 (a) Explain what the unlevered betas tell you about the firms. (1 mark) (b) Estimate the unlevered beta of each firm. (4 marks) (c) If you were valuing an initial public offering for a breakfast cereals business, what beta would you use in the valuation? Assume that the firm going public plans to have a debt/equity ratio of 35%. (4 marks) (d) Assume now that Company B is considering expanding its operations into the health care business. The health care business is expected to be 30% of the overall firm value, and the average beta of comparable firms is 0.95; the average debt/equity ratio for these firms is 35%. Estimate the new beta for Company B, assuming that it maintains its current debt/equity ratio. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts