Question: Question 2 (15 marks) You have been tasked to perform an investment analysis of an office building that your client is considering in acquiring. The

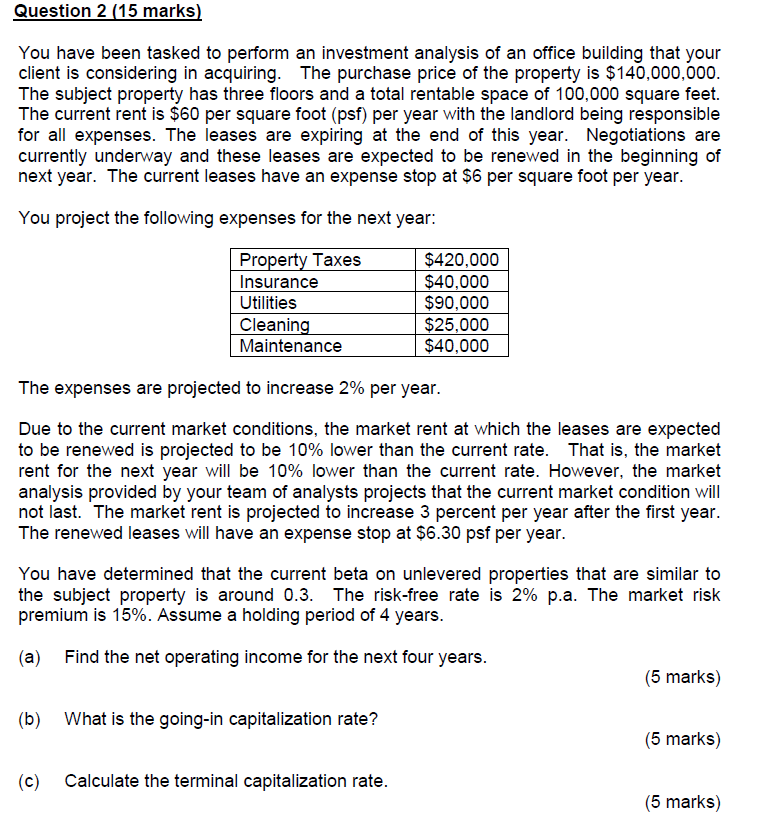

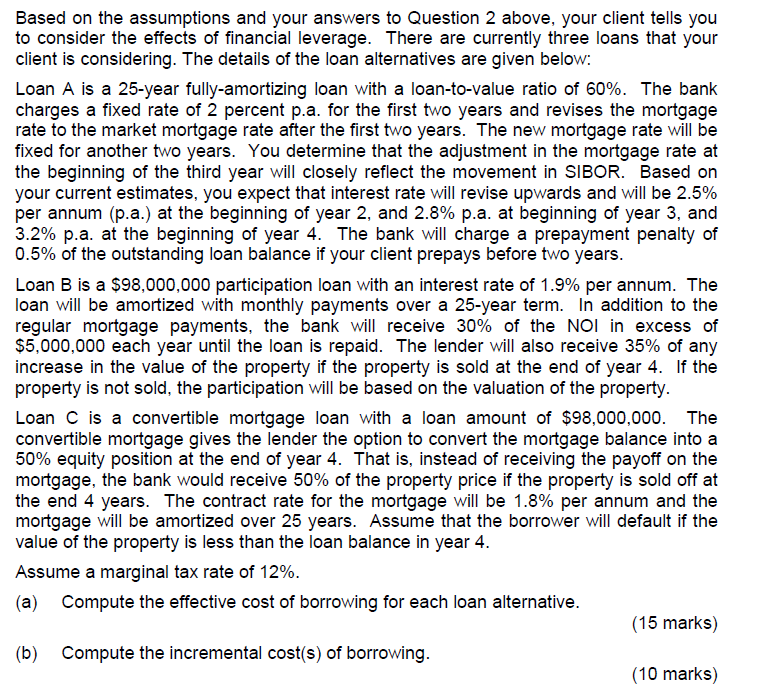

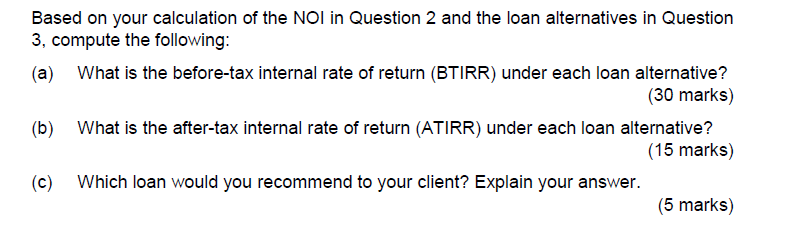

Question 2 (15 marks) You have been tasked to perform an investment analysis of an office building that your client is considering in acquiring. The purchase price of the property is $140,000,000. The subject property has three floors and a total rentable space of 100,000 square feet. The current rent is $60 per square foot (psf) per year with the landlord being responsible for all expenses. The leases are expiring at the end of this year. Negotiations are currently underway and these leases are expected to be renewed in the beginning of next year. The current leases have an expense stop at $6 per square foot per year. You project the following expenses for the next year: Property Taxes $420,000 Insurance $40,000 Utilities $90,000 Cleaning $25,000 Maintenance $40,000 The expenses are projected to increase 2% per year. Due to the current market conditions, the market rent at which the leases are expected to be renewed is projected to be 10% lower than the current rate. That is, the market rent for the next year will be 10% lower than the current rate. However, the market analysis provided by your team of analysts projects that the current market condition will not last. The market rent is projected to increase 3 percent per year after the first year. The renewed leases will have an expense stop at $6.30 psf per year. You have determined that the current beta on unlevered properties that are similar to the subject property is around 0.3. The risk-free rate is 2% p.a. The market risk premium is 15%. Assume a holding period of 4 years. (a) Find the net operating income for the next four years. (5 marks) (b) What is the going-in capitalization rate? (5 marks) (C) ( Calculate the terminal capitalization rate. (5 marks) Based on the assumptions and your answers to Question 2 above, your client tells you to consider the effects of financial leverage. There are currently three loans that your client is considering. The details of the loan alternatives are given below: Loan A is a 25-year fully-amortizing loan with a loan-to-value ratio of 60%. The bank charges a fixed rate of 2 percent p.a. for the first two years and revises the mortgage rate to the market mortgage rate after the first two years. The new mortgage rate will be fixed for another two years. You determine that the adjustment in the mortgage rate at the beginning of the third year will closely reflect the movement in SIBOR. Based on your current estimates, you expect that interest rate will revise upwards and will be 2.5% per annum (p.a.) at the beginning of year 2, and 2.8% p.a. at beginning of year 3, and 3.2% p.a. at the beginning of year 4. The bank will charge a prepayment penalty of 0.5% of the outstanding loan balance if your client prepays before two years. Loan B is a $98,000,000 participation loan with an interest rate of 1.9% per annum. The loan will be amortized with monthly payments over a 25-year term. In addition to the regular mortgage payments, the bank will receive 30% of the NOI in excess of $5,000,000 each year until the loan is repaid. The lender will also receive 35% of any increase in the value of the property if the property is sold at the end of year 4. If the property is not sold, the participation will be based on the valuation of the property. Loan C is a convertible mortgage loan with a loan amount of $98,000,000. The convertible mortgage gives the lender the option to convert the mortgage balance into a 50% equity position at the end of year 4. That is, instead of receiving the payoff on the mortgage, the bank would receive 50% of the property price if the property is sold off at the end 4 years. The contract rate for the mortgage will be 1.8% per annum and the mortgage will be amortized over 25 years. Assume that the borrower will default if the value of the property is less than the loan balance in year 4. Assume a marginal tax rate of 12%. (a) Compute the effective cost of borrowing for each loan alternative. (15 marks) (b) Compute the incremental cost(s) of borrowing. (10 marks) Based on your calculation of the NOI in Question 2 and the loan alternatives in Question 3, compute the following: (a) What is the before-tax internal rate of return (BTIRR) under each loan alternative? (30 marks) (b) What is the after-tax internal rate of return (ATIRR) under each loan alternative? (15 marks) (C) Which loan would you recommend to your client? Explain your answer. (5 marks) Question 2 (15 marks) You have been tasked to perform an investment analysis of an office building that your client is considering in acquiring. The purchase price of the property is $140,000,000. The subject property has three floors and a total rentable space of 100,000 square feet. The current rent is $60 per square foot (psf) per year with the landlord being responsible for all expenses. The leases are expiring at the end of this year. Negotiations are currently underway and these leases are expected to be renewed in the beginning of next year. The current leases have an expense stop at $6 per square foot per year. You project the following expenses for the next year: Property Taxes $420,000 Insurance $40,000 Utilities $90,000 Cleaning $25,000 Maintenance $40,000 The expenses are projected to increase 2% per year. Due to the current market conditions, the market rent at which the leases are expected to be renewed is projected to be 10% lower than the current rate. That is, the market rent for the next year will be 10% lower than the current rate. However, the market analysis provided by your team of analysts projects that the current market condition will not last. The market rent is projected to increase 3 percent per year after the first year. The renewed leases will have an expense stop at $6.30 psf per year. You have determined that the current beta on unlevered properties that are similar to the subject property is around 0.3. The risk-free rate is 2% p.a. The market risk premium is 15%. Assume a holding period of 4 years. (a) Find the net operating income for the next four years. (5 marks) (b) What is the going-in capitalization rate? (5 marks) (C) ( Calculate the terminal capitalization rate. (5 marks) Based on the assumptions and your answers to Question 2 above, your client tells you to consider the effects of financial leverage. There are currently three loans that your client is considering. The details of the loan alternatives are given below: Loan A is a 25-year fully-amortizing loan with a loan-to-value ratio of 60%. The bank charges a fixed rate of 2 percent p.a. for the first two years and revises the mortgage rate to the market mortgage rate after the first two years. The new mortgage rate will be fixed for another two years. You determine that the adjustment in the mortgage rate at the beginning of the third year will closely reflect the movement in SIBOR. Based on your current estimates, you expect that interest rate will revise upwards and will be 2.5% per annum (p.a.) at the beginning of year 2, and 2.8% p.a. at beginning of year 3, and 3.2% p.a. at the beginning of year 4. The bank will charge a prepayment penalty of 0.5% of the outstanding loan balance if your client prepays before two years. Loan B is a $98,000,000 participation loan with an interest rate of 1.9% per annum. The loan will be amortized with monthly payments over a 25-year term. In addition to the regular mortgage payments, the bank will receive 30% of the NOI in excess of $5,000,000 each year until the loan is repaid. The lender will also receive 35% of any increase in the value of the property if the property is sold at the end of year 4. If the property is not sold, the participation will be based on the valuation of the property. Loan C is a convertible mortgage loan with a loan amount of $98,000,000. The convertible mortgage gives the lender the option to convert the mortgage balance into a 50% equity position at the end of year 4. That is, instead of receiving the payoff on the mortgage, the bank would receive 50% of the property price if the property is sold off at the end 4 years. The contract rate for the mortgage will be 1.8% per annum and the mortgage will be amortized over 25 years. Assume that the borrower will default if the value of the property is less than the loan balance in year 4. Assume a marginal tax rate of 12%. (a) Compute the effective cost of borrowing for each loan alternative. (15 marks) (b) Compute the incremental cost(s) of borrowing. (10 marks) Based on your calculation of the NOI in Question 2 and the loan alternatives in Question 3, compute the following: (a) What is the before-tax internal rate of return (BTIRR) under each loan alternative? (30 marks) (b) What is the after-tax internal rate of return (ATIRR) under each loan alternative? (15 marks) (C) Which loan would you recommend to your client? Explain your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts