Question: Question 2 (15 points) Complete a sales comparison approach using the following data: In your adjustment grid on the following page, round all adjustments to

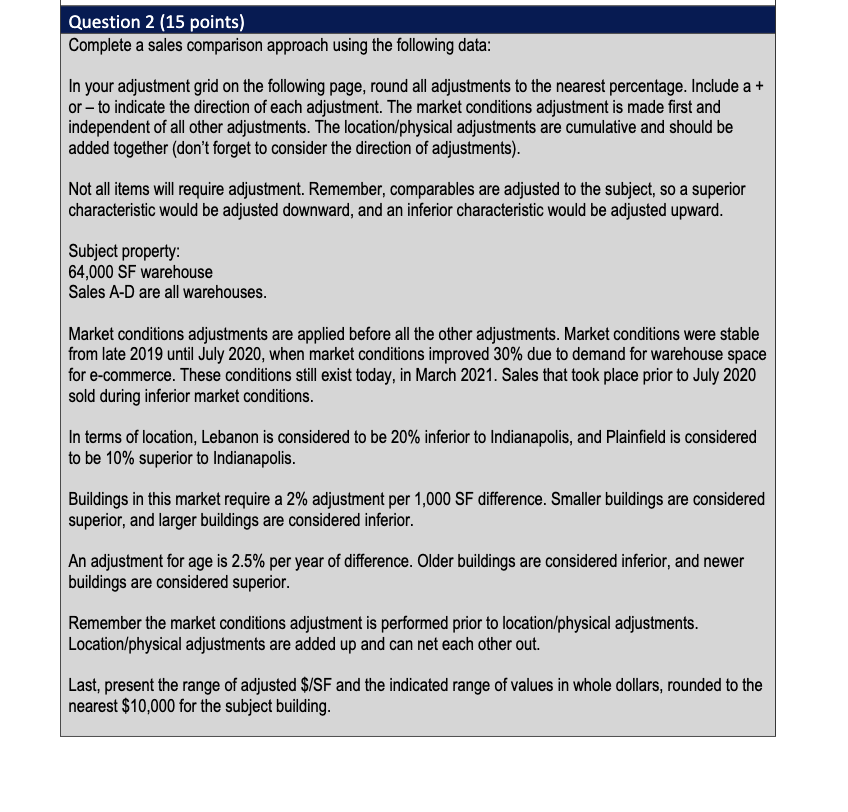

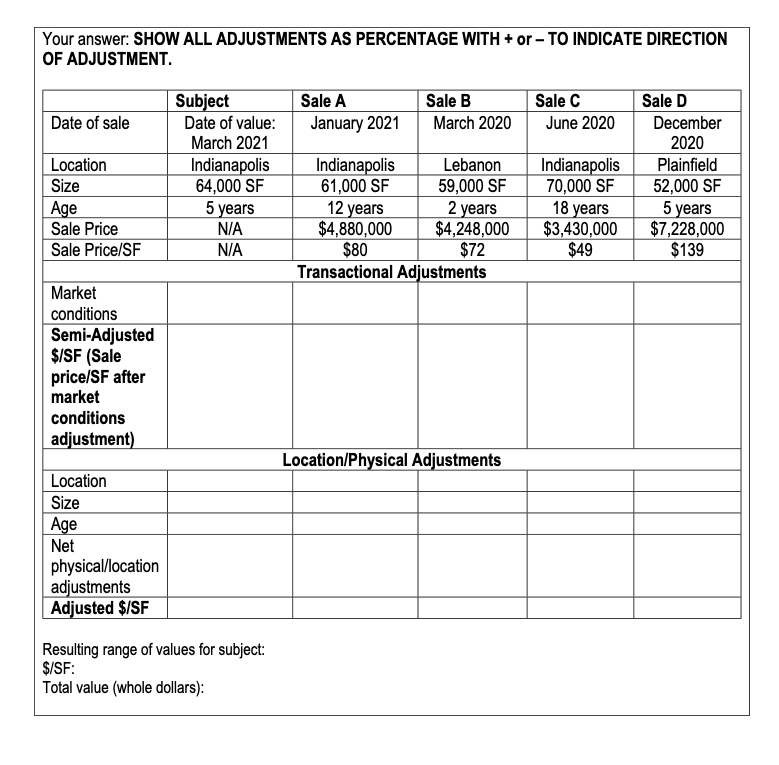

Question 2 (15 points) Complete a sales comparison approach using the following data: In your adjustment grid on the following page, round all adjustments to the nearest percentage. Include a + or to indicate the direction of each adjustment. The market conditions adjustment is made first and independent of all other adjustments. The location/physical adjustments are cumulative and should be added together (don't forget to consider the direction of adjustments). Not all items will require adjustment. Remember, comparables are adjusted to the subject, so a superior characteristic would be adjusted downward, and an inferior characteristic would be adjusted upward. Subject property: 64,000 SF warehouse Sales A-D are all warehouses. Market conditions adjustments are applied before all the other adjustments. Market conditions were stable from late 2019 until July 2020, when market conditions improved 30% due to demand for warehouse space for e-commerce. These conditions still exist today, in March 2021. Sales that took place prior to July 2020 sold during inferior market conditions. In terms of location, Lebanon is considered to be 20% inferior to Indianapolis, and Plainfield is considered to be 10% superior to Indianapolis. Buildings in this market require a 2% adjustment per 1,000 SF difference. Smaller buildings are considered superior, and larger buildings are considered inferior. An adjustment for age is 2.5% per year of difference. Older buildings are considered inferior, and newer buildings are considered superior. Remember the market conditions adjustment is performed prior to location/physical adjustments. Location/physical adjustments are added up and can net each other out. Last, present the range of adjusted $/SF and the indicated range of values in whole dollars, rounded to the nearest $10,000 for the subject building. Your answer: SHOW ALL ADJUSTMENTS AS PERCENTAGE WITH + or - TO INDICATE DIRECTION OF ADJUSTMENT. Sale A January 2021 Sale B March 2020 Date of sale Sale C June 2020 Location Size Age Sale Price Sale Price/SF Subject Date of value: March 2021 Indianapolis 64,000 SF 5 years Indianapolis Lebanon 61,000 SF 59,000 SF 12 years 2 years $4,880,000 $4,248,000 $80 Transactional Adjustments Indianapolis 70,000 SF 18 years $3,430,000 $49 Sale D December 2020 Plainfield 52,000 SF 5 years $7,228,000 $139 $72 Market conditions Semi-Adjusted $/SF (Sale price/SF after market conditions adjustment) Location/Physical Adjustments Location Size Age Net physical/location adjustments Adjusted $/SF Resulting range of values for subject: $/SF: Total value (whole dollars): Question 2 (15 points) Complete a sales comparison approach using the following data: In your adjustment grid on the following page, round all adjustments to the nearest percentage. Include a + or to indicate the direction of each adjustment. The market conditions adjustment is made first and independent of all other adjustments. The location/physical adjustments are cumulative and should be added together (don't forget to consider the direction of adjustments). Not all items will require adjustment. Remember, comparables are adjusted to the subject, so a superior characteristic would be adjusted downward, and an inferior characteristic would be adjusted upward. Subject property: 64,000 SF warehouse Sales A-D are all warehouses. Market conditions adjustments are applied before all the other adjustments. Market conditions were stable from late 2019 until July 2020, when market conditions improved 30% due to demand for warehouse space for e-commerce. These conditions still exist today, in March 2021. Sales that took place prior to July 2020 sold during inferior market conditions. In terms of location, Lebanon is considered to be 20% inferior to Indianapolis, and Plainfield is considered to be 10% superior to Indianapolis. Buildings in this market require a 2% adjustment per 1,000 SF difference. Smaller buildings are considered superior, and larger buildings are considered inferior. An adjustment for age is 2.5% per year of difference. Older buildings are considered inferior, and newer buildings are considered superior. Remember the market conditions adjustment is performed prior to location/physical adjustments. Location/physical adjustments are added up and can net each other out. Last, present the range of adjusted $/SF and the indicated range of values in whole dollars, rounded to the nearest $10,000 for the subject building. Your answer: SHOW ALL ADJUSTMENTS AS PERCENTAGE WITH + or - TO INDICATE DIRECTION OF ADJUSTMENT. Sale A January 2021 Sale B March 2020 Date of sale Sale C June 2020 Location Size Age Sale Price Sale Price/SF Subject Date of value: March 2021 Indianapolis 64,000 SF 5 years Indianapolis Lebanon 61,000 SF 59,000 SF 12 years 2 years $4,880,000 $4,248,000 $80 Transactional Adjustments Indianapolis 70,000 SF 18 years $3,430,000 $49 Sale D December 2020 Plainfield 52,000 SF 5 years $7,228,000 $139 $72 Market conditions Semi-Adjusted $/SF (Sale price/SF after market conditions adjustment) Location/Physical Adjustments Location Size Age Net physical/location adjustments Adjusted $/SF Resulting range of values for subject: $/SF: Total value (whole dollars)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts