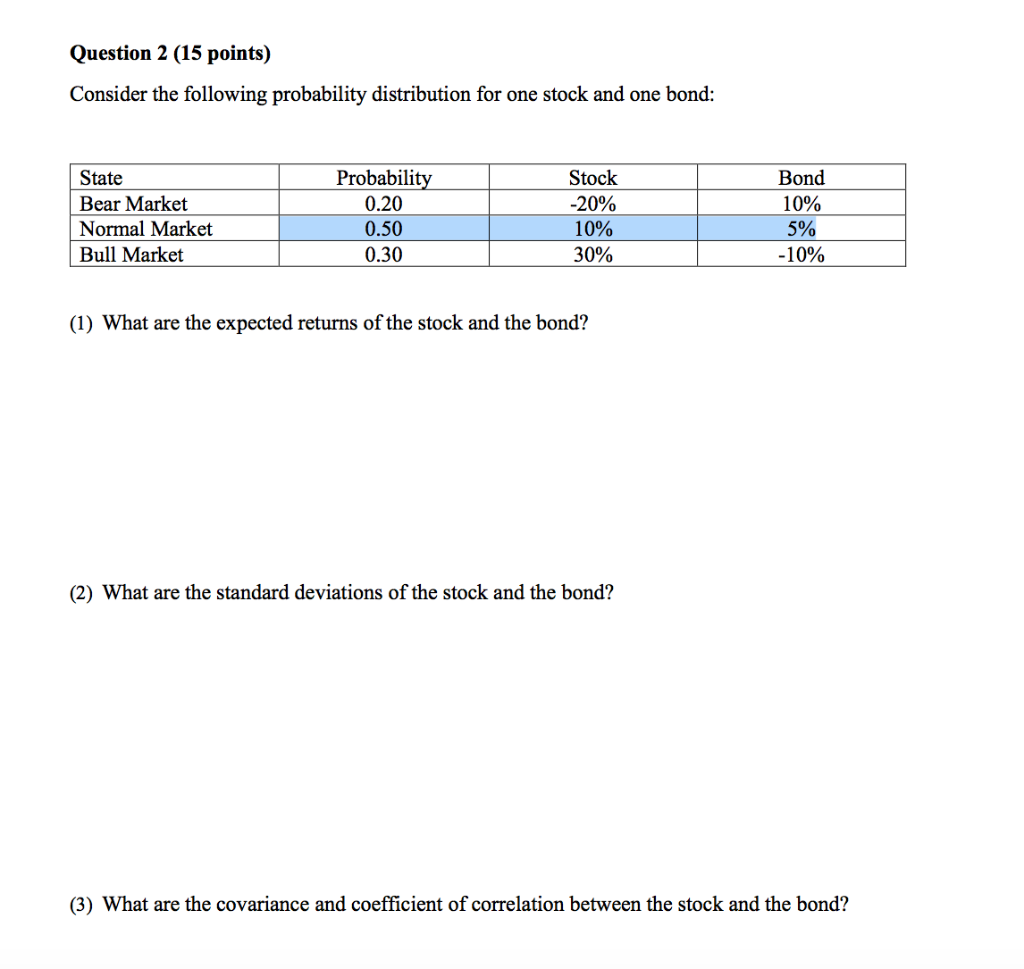

Question: Question 2 (15 points) Consider the following probability distribution for one stock and one bond: State Bear Market Normal Market Bull Market Probability 0.20 0.50

Question 2 (15 points) Consider the following probability distribution for one stock and one bond: State Bear Market Normal Market Bull Market Probability 0.20 0.50 0.30 Stock -20% 10% 30% Bond 10% 5% -10% (1) What are the expected returns of the stock and the bond? (2) What are the standard deviations of the stock and the bond? (3) What are the covariance and coefficient of correlation between the stock and the bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts