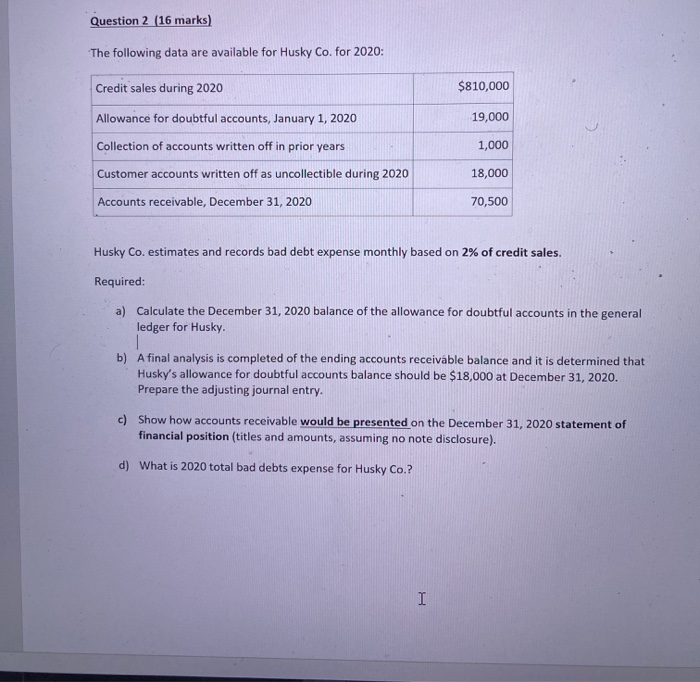

Question: Question 2 (16 marks) The following data are available for Husky Co. for 2020: Credit sales during 2020 $810,000 Allowance for doubtful accounts, January 1,

Question 2 (16 marks) The following data are available for Husky Co. for 2020: Credit sales during 2020 $810,000 Allowance for doubtful accounts, January 1, 2020 19,000 Collection of accounts written off in prior years 1,000 Customer accounts written off as uncollectible during 2020 18,000 Accounts receivable, December 31, 2020 70,500 Husky Co. estimates and records bad debt expense monthly based on 2% of credit sales. Required: a) Calculate the December 31, 2020 balance of the allowance for doubtful accounts in the general ledger for Husky. 1 b) A final analysis is completed of the ending accounts receivable balance and it is determined that Husky's allowance for doubtful accounts balance should be $18,000 at December 31, 2020. Prepare the adjusting journal entry. c) Show how accounts receivable would be presented on the December 31, 2020 statement of financial position (titles and amounts, assuming no note disclosure). d) What is 2020 total bad debts expense for Husky Co

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts