Question: Question 2 (16.67 points) Saved Assume that you are doing a valuation, where you are comparing the price to book ratio of GenSys Bank to

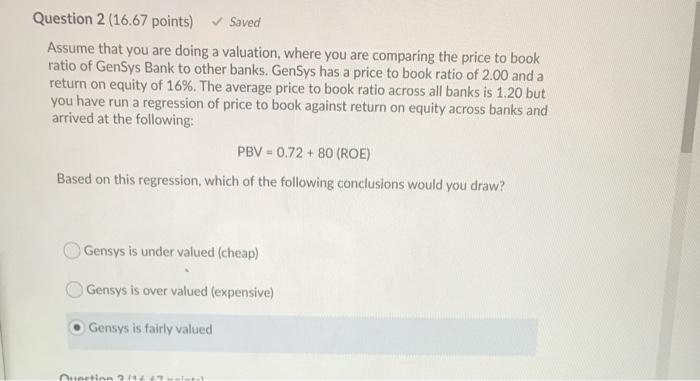

Question 2 (16.67 points) Saved Assume that you are doing a valuation, where you are comparing the price to book ratio of GenSys Bank to other banks. GenSys has a price to book ratio of 2.00 and a return on equity of 16%. The average price to book ratio across all banks is 1.20 but you have run a regression of price to book against return on equity across banks and arrived at the following: PBV = 0.72 + 80 (ROE) Based on this regression, which of the following conclusions would you draw? Gensys is under valued (cheap) Gensys is over valued (expensive) Gensys is fairly valued hng l 24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts