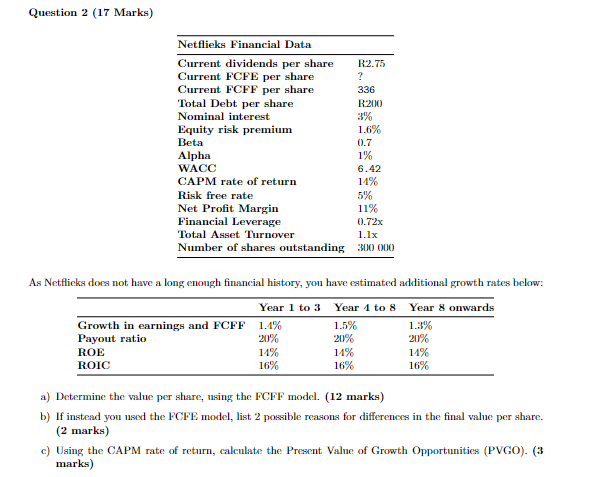

Question: Question 2 (17 Marks) Netflieks Financial Data R2.75 ? Current dividends per share Current FCFE per share Current FCFF per share Total Debt per share

Question 2 (17 Marks) Netflieks Financial Data R2.75 ? Current dividends per share Current FCFE per share Current FCFF per share Total Debt per share 336 R200 Nominal interest 3% 1.6% Equity risk premium Beta 0.7 1% Alpha WACC 6.42 CAPM rate of return 14% Risk free rate 5% Net Profit Margin 11% Financial Leverage 0.72x Total Asset Turnover 1.1x Number of shares outstanding 300 000 As Netflicks does not have a long enough financial history, you have estimated additional growth rates below: Year 1 to 3 Year 1 to 8 Year 8 onwards 1.5% 1.3% Growth in earnings and FCFF 1.4% Payout ratio 20% 20% 20% 14% 14% 14% ROE ROIC 16% 16% 16% a) Determine the value per share, using the FCFF model. (12 marks) b) If instead you used the FCFE model, list 2 possible reasons for differences in the final value per share. (2 marks) c) Using the CAPM rate of return, calculate the Present Value of Growth Opportunities (PVGO)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts