Question: Question 2 ( 2 0 marks ) An investor, Adam, currently holds his entire investment in the stock of Novo Corporation ( Ticker: N )

Question marks

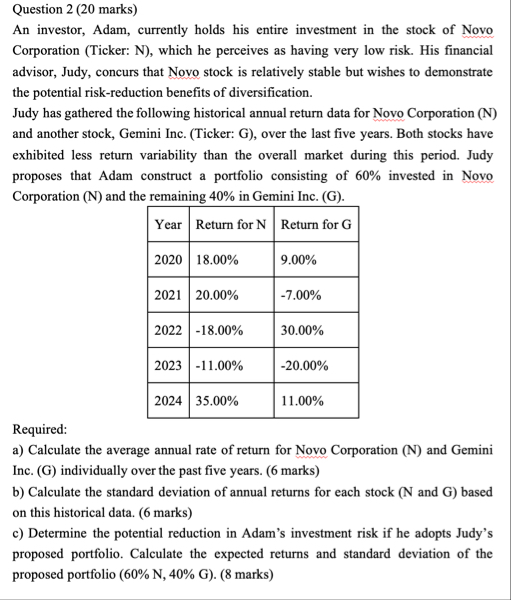

An investor, Adam, currently holds his entire investment in the stock of Novo Corporation Ticker: N which he perceives as having very low risk. His financial advisor, Judy, concurs that Novo stock is relatively stable but wishes to demonstrate the potential riskreduction benefits of diversification.

Judy has gathered the following historical annual return data for Novo Corporation N and another stock, Gemini Inc. Ticker: G over the last five years. Both stocks have exhibited less return variability than the overall market during this period. Judy proposes that Adam construct a portfolio consisting of invested in Novo Corporation N and the remaining in Gemini Inc. G

tableYearReturn for NReturn for G

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock