Question: QUESTION 2 ( 2 0 MARKS ) Based on the information provided below, answer the following questions. INFORMATION Pratt & Gumbos ( Pty )

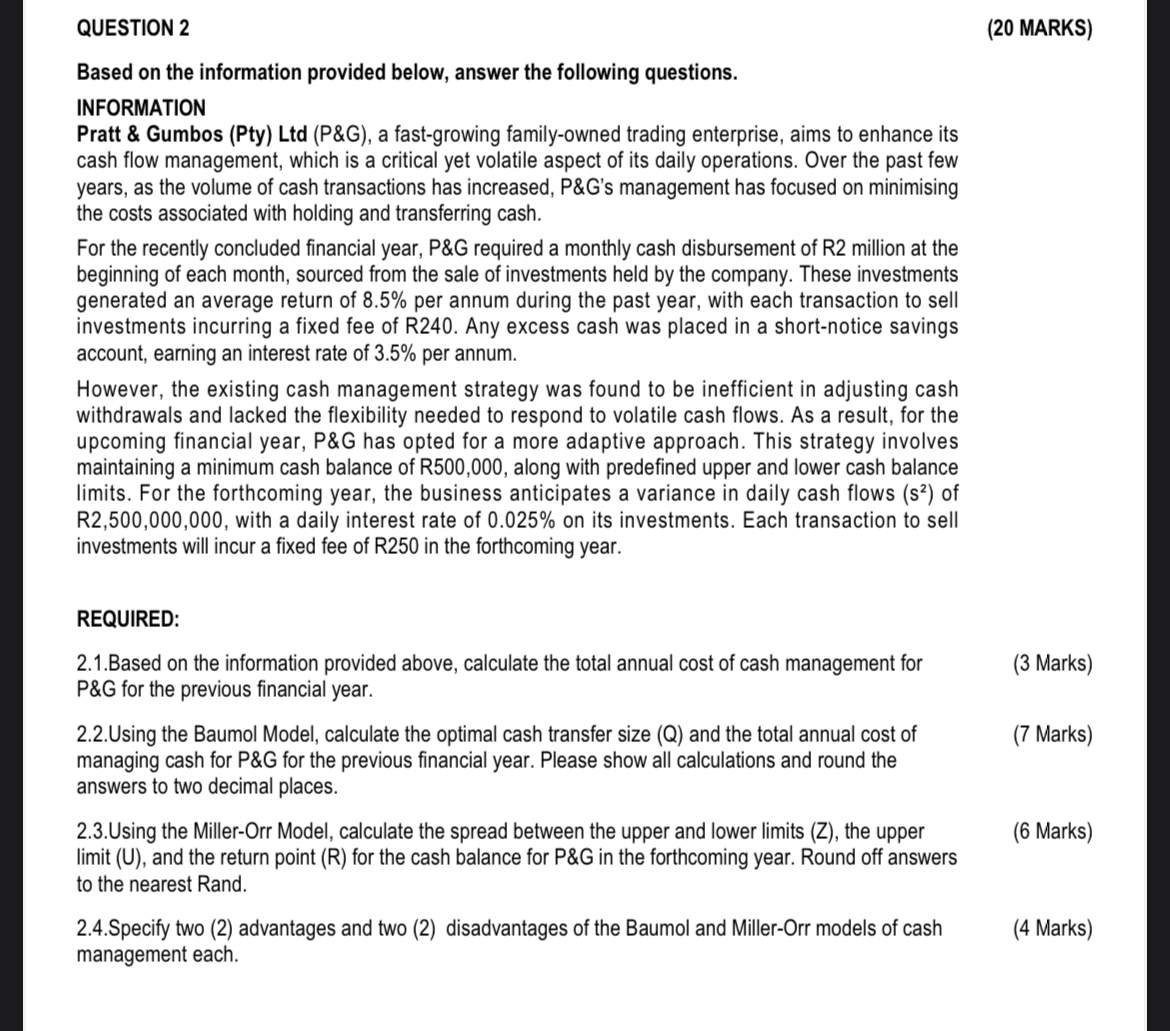

QUESTION MARKS Based on the information provided below, answer the following questions. INFORMATION Pratt & Gumbos Pty Ltd P&G a fastgrowing familyowned trading enterprise, aims to enhance its cash flow management, which is a critical yet volatile aspect of its daily operations. Over the past few years, as the volume of cash transactions has increased, P&Gs management has focused on minimising the costs associated with holding and transferring cash. For the recently concluded financial year, P&G required a monthly cash disbursement of R million at the beginning of each month, sourced from the sale of investments held by the company. These investments generated an average return of per annum during the past year, with each transaction to sell investments incurring a fixed fee of R Any excess cash was placed in a shortnotice savings account, earning an interest rate of per annum. However, the existing cash management strategy was found to be inefficient in adjusting cash withdrawals and lacked the flexibility needed to respond to volatile cash flows. As a result, for the upcoming financial year, mathrmP& mathrmG has opted for a more adaptive approach. This strategy involves maintaining a minimum cash balance of R along with predefined upper and lower cash balance limits For the forthcoming year, the business anticipates a variance in daily cash flows mathrms of R with a daily interest rate of on its investments. Each transaction to sell investments will incur a fixed fee of R in the forthcoming year. REQUIRED: Based on the information provided above, calculate the total annual cost of cash management for Marks P&G for the previous financial year. Using the Baumol Model, calculate the optimal cash transfer size Q and the total annual cost of managing cash for P&G for the previous financial year. Please show all calculations and round the answers to two decimal places. Using the MillerOrr Model, calculate the spread between the upper and lower limits Z the upper limit mathrmU and the return point mathrmR for the cash balance for mathrmP& mathrmG in the forthcoming year. Round off answers to the nearest Rand. Specify two advantages and two disadvantages of the Baumol and MillerOrr models of cash management each.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock