Question: QUESTION 2 ( 2 0 Marks ) REQUIRED Prepare the Statement of Changes in Equity for the year ended 2 9 February 2 0 2

QUESTION

Marks

REQUIRED

Prepare the Statement of Changes in Equity for the year ended February

INFORMATION

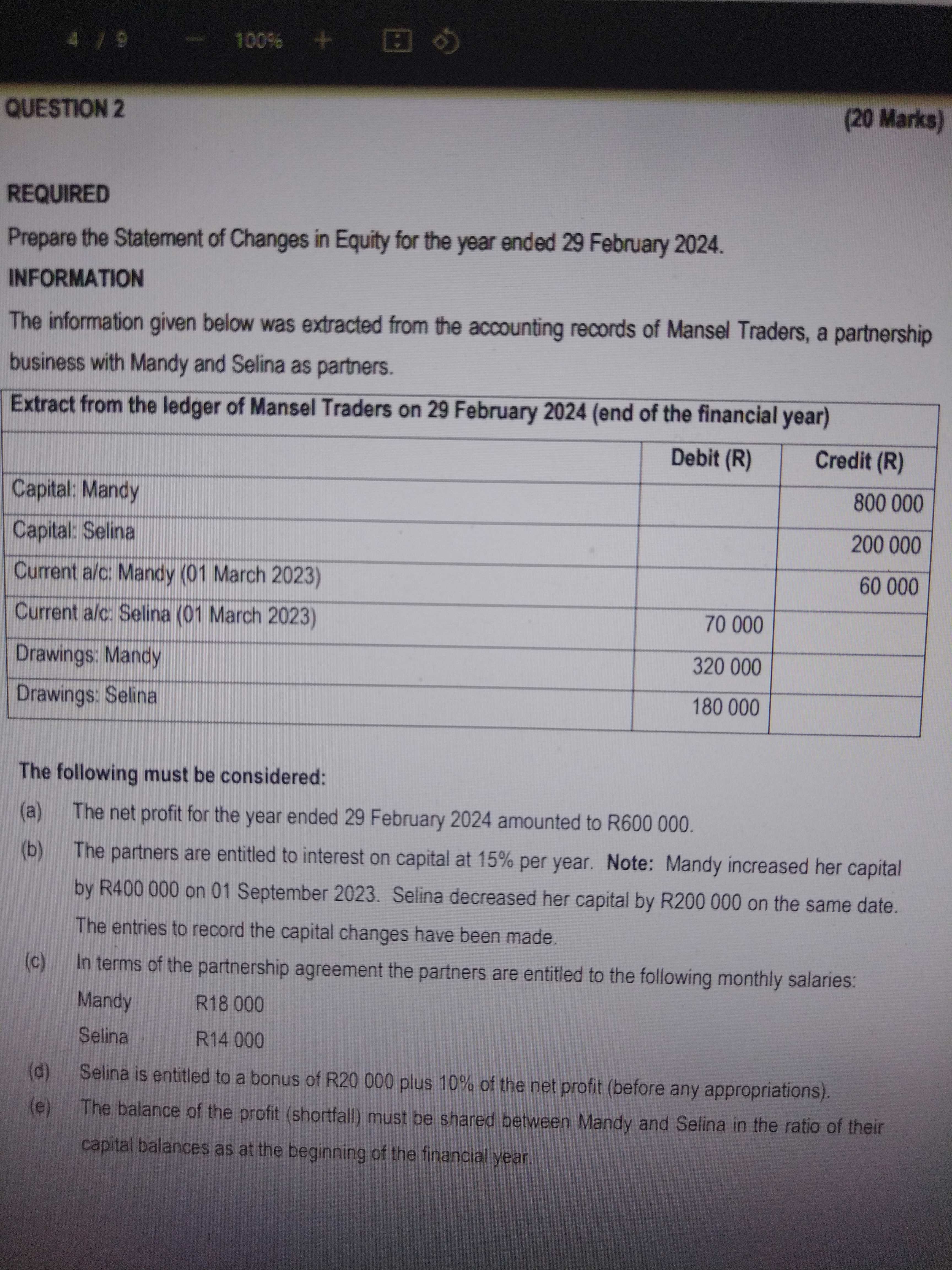

The information given below was extracted from the accounting records of Mansel Traders, a partnership business with Mandy and Selina as partners.

Extract from the ledger of Mansel Traders on February end of the financial year

begintabularlrr

hline & multicolumnc Debit R & multicolumnc Credit R

hline Capital: Mandy & &

hline Capital: Selina & &

hline Current ac: Mandy March & &

hline Current ac: Selina March & &

hline Drawings: Mandy & &

hline Drawings: Selina & &

hline

endtabular

The following must be considered:

a The net profit for the year ended February amounted to R

b The partners are entitled to interest on capital at per year. Note: Mandy increased her capital by R on September Selina decreased her capital by R on the same date. The entries to record the capital changes have been made.

c In terms of the partnership agreement the partners are entitled to the following monthly salaries:

Mandy R

Selina R

d Selina is entitled to a bonus of R plus of the net profit before any appropriations

e The balance of the profit shortfall must be shared between Mandy and Selina in the ratio of their capital balances as at the beginning of the financial year.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock