Question: Question 2 ( 2 0 minutes, 1 2 marks ) Foster Company makes 2 0 , 0 0 0 units per year o f a

Question minutes, marks

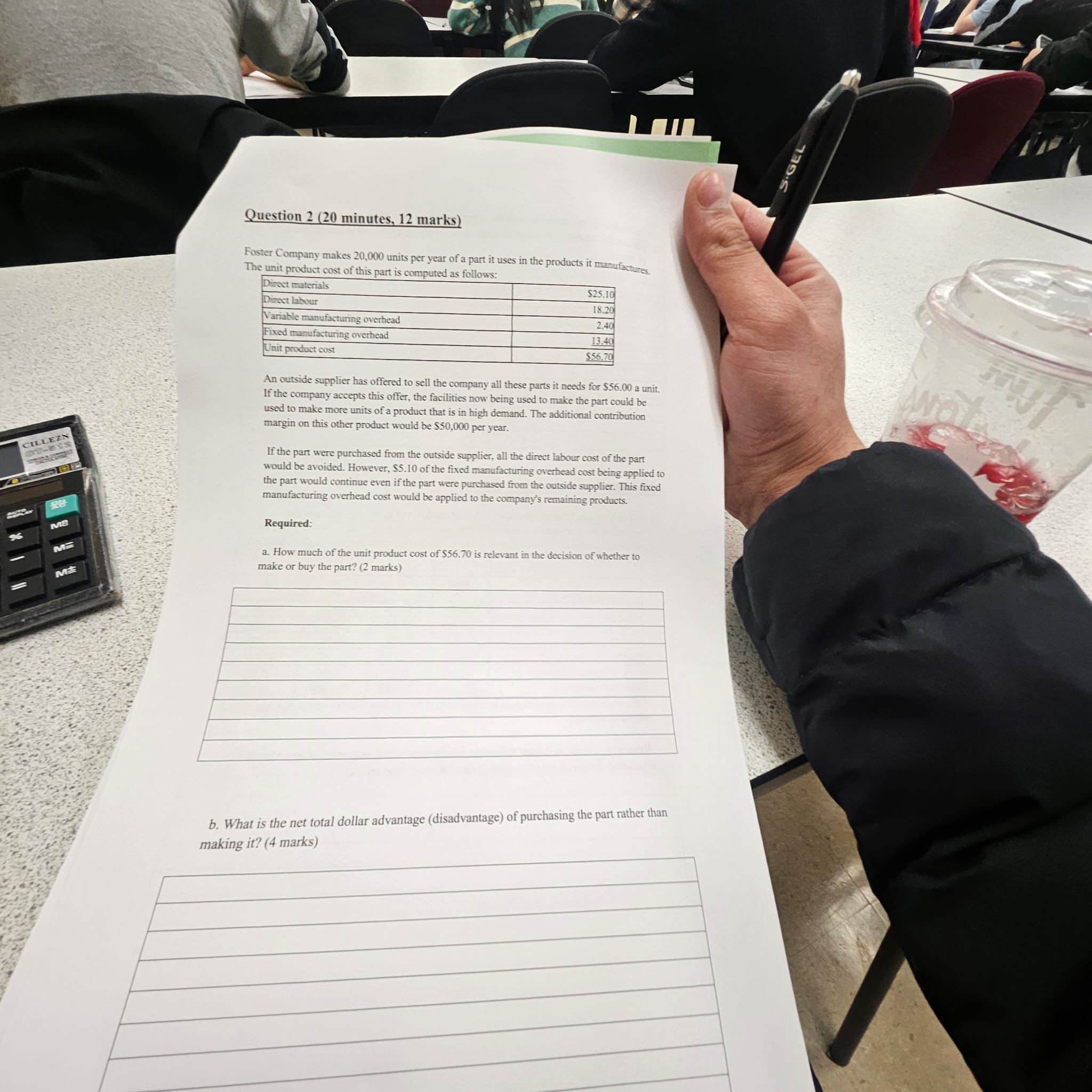

Foster Company makes units per year a part uses the products manufactures. The unit product cost this part computed follows:

outside supplier has offered sell the company all these parts needs for $ a unit. the company accepts this offer, the facilities now being used make the part could used make more units a product that high demand. The additional contribution margin this other product would $ per year.

the part were purchased from the outside supplier, all the direct labour cost the part would avoided. However, $ the fixed manufacturing overhead cost being applied the part would continue even the part were purchased from the outside supplier. This fixed manufacturing overhead cost would applied the company's remaining products.

Required:

How much the unit product cost $ relevant the decision whether make buy the part? marks

What the net total dollar advantage purchasing the part rather than

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock