Question: Question 2 : 2 0 points Welles Company reported the following data for 2 0 2 5 . Net income, $ 6 , 2 1

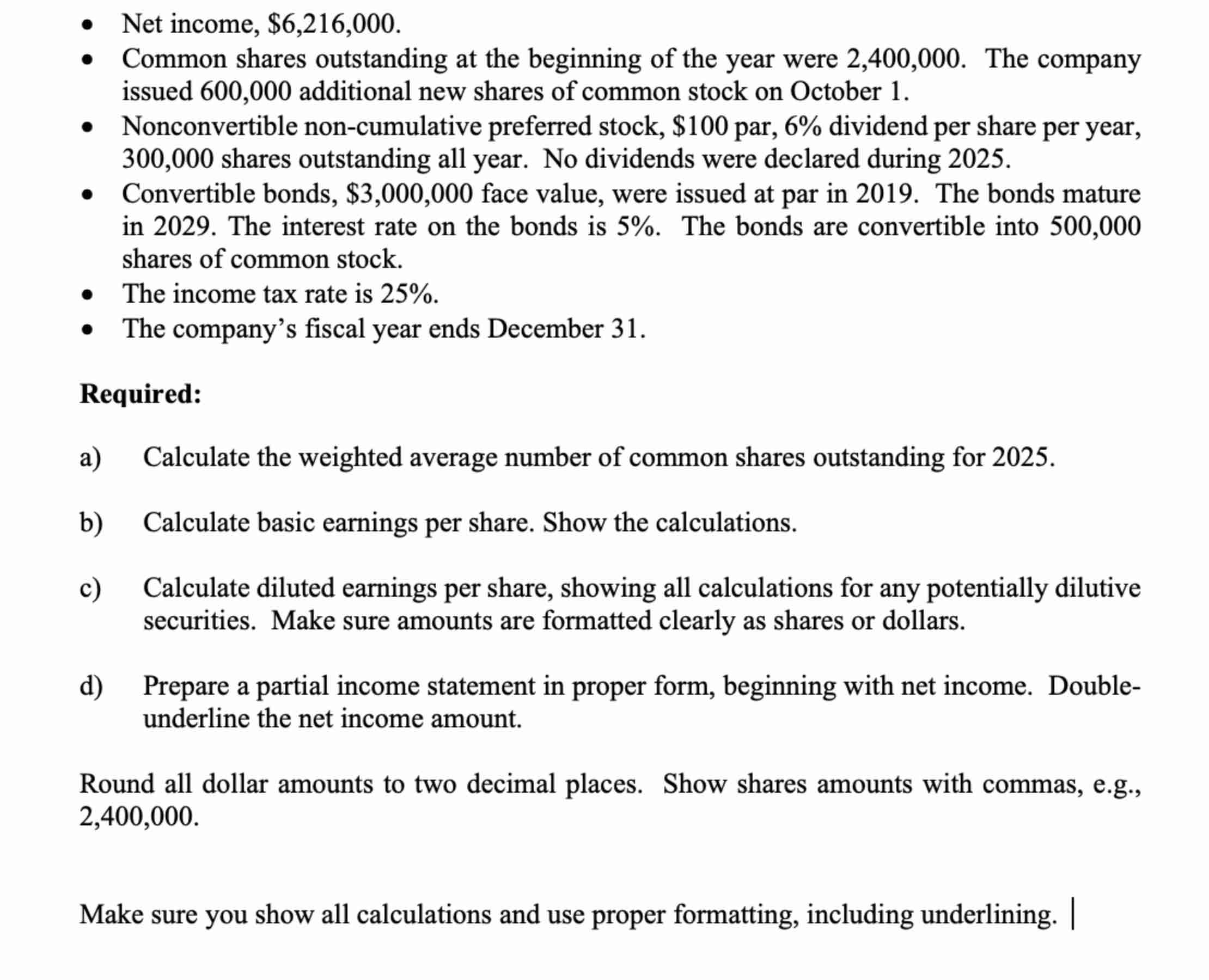

Question : points Welles Company reported the following data for Net income, $ Common shares outstanding at the beginning of the year were The company issued additional new shares of common stock on October Nonconvertible noncumulative preferred stock, $ par, dividend per share per year, shares outstanding all year. No dividends were declared during Convertible bonds, $ face value, were issued at par in The bonds mature in The interest rate on the bonds is The bonds are convertible into shares of common stock. The income tax rate is The companys fiscal year ends December Required: a Calculate the weighted average number of common shares outstanding for b Calculate basic earnings per share. Show the calculations. c Calculate diluted earnings per share, showing all calculations for any potentially dilutive securities Make sure amounts are formatted clearly as shares or dollars. d Prepare a partial income statement in proper form, beginning with net income. Doubleunderline the net income amount. Round all dollar amounts to two decimal places. Show shares amounts with commas, eg Make sure you show all calculations and use proper formatting, including underlining. Net income, $

Common shares outstanding at the beginning of the year were The company issued additional new shares of common stock on October

Nonconvertible noncumulative preferred stock, $ mathrmpar dividend per share per year, shares outstanding all year. No dividends were declared during

Convertible bonds, $ face value, were issued at par in The bonds mature in The interest rate on the bonds is The bonds are convertible into shares of common stock.

The income tax rate is

The company's fiscal year ends December

Required:

a Calculate the weighted average number of common shares outstanding for

b Calculate basic earnings per share. Show the calculations.

c Calculate diluted earnings per share, showing all calculations for any potentially dilutive securities Make sure amounts are formatted clearly as shares or dollars.

d Prepare a partial income statement in proper form, beginning with net income. Doubleunderline the net income amount.

Round all dollar amounts to two decimal places. Show shares amounts with commas, eg

Make sure you show all calculations and use proper formatting, including underlining.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock