Question: QUESTION 2 . 2 ( 1 0 marks ) During February 2 0 2 4 the following transactions occurred at a business that buys and

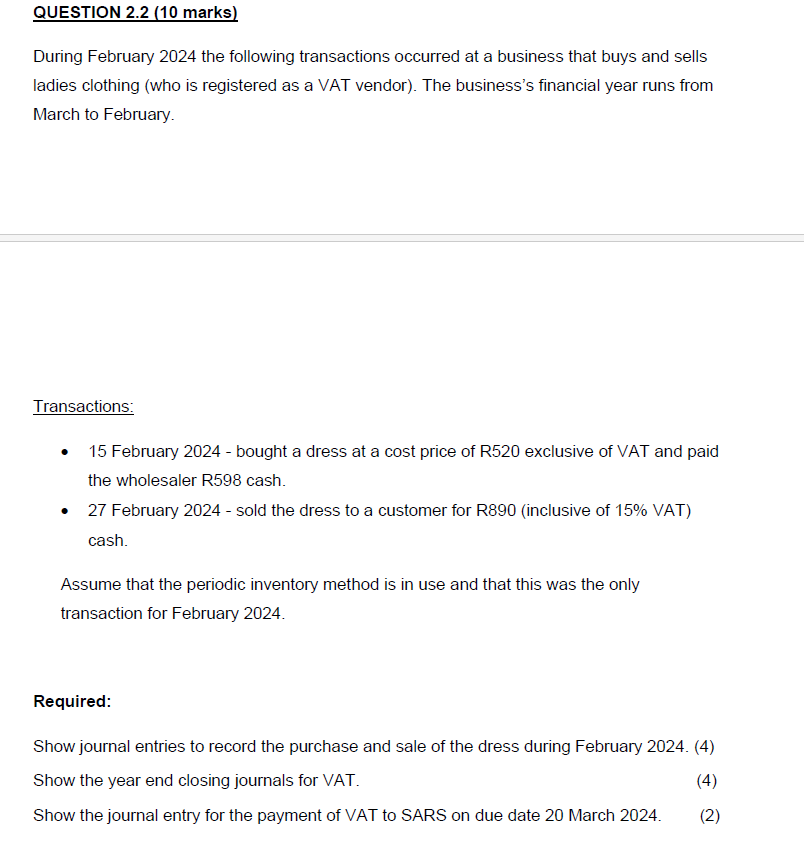

QUESTION marks During February the following transactions occurred at a business that buys and sells ladies clothing who is registered as a VAT vendor The business's financial year runs from March to February. Transactions: February bought a dress at a cost price of R exclusive of VAT and paid the wholesaler R cash. February sold the dress to a customer for Rinclusive of VAT cash. Assume that the periodic inventory method is in use and that this was the only transaction for February Required: Show journal entries to record the purchase and sale of the dress during February Show the year end closing journals for VAT. Show the journal entry for the payment of VAT to SARS on due date March

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock