Question: Question 2 2 ( 1 . 5 points ) If presented with the option between two equally risky annuities, each disbursing $ 1 0 ,

Question points

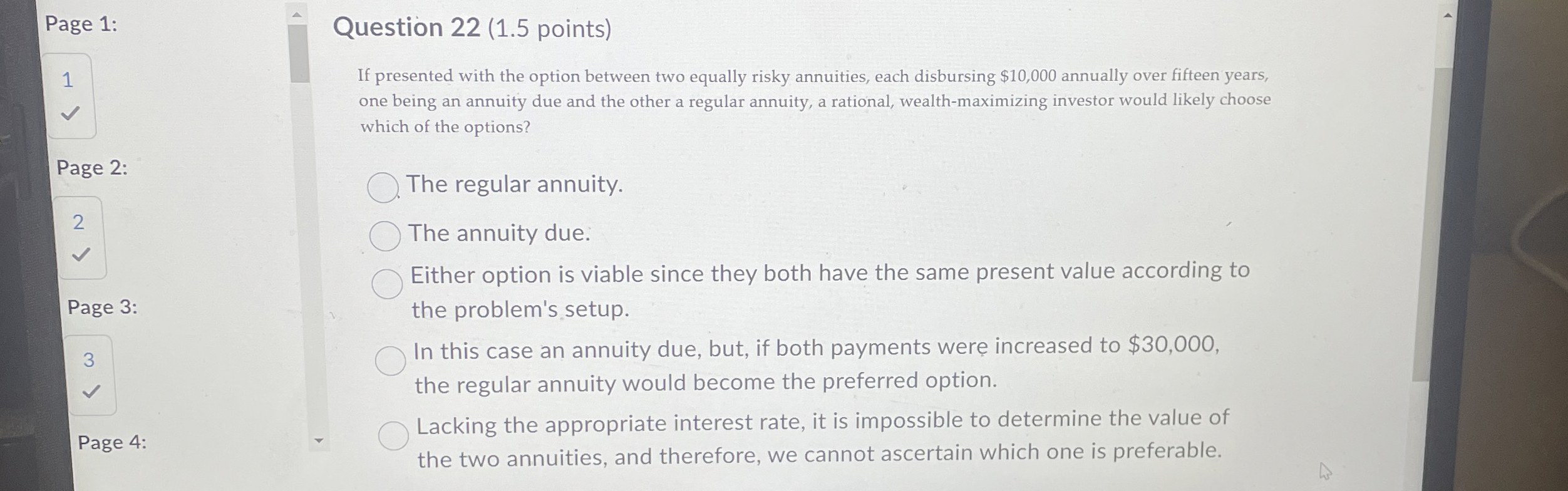

If presented with the option between two equally risky annuities, each disbursing $ annually over fifteen years,

one being an annuity due and the other a regular annuity, a rational, wealthmaximizing investor would likely choose

which of the options?

The regular annuity.

The annuity due.

Either option is viable since they both have the same present value according to

the problem's setup.

In this case an annuity due, but, if both payments were increased to $

the regular annuity would become the preferred option.

Lacking the appropriate interest rate, it is impossible to determine the value of

the two annuities, and therefore, we cannot ascertain which one is preferable.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock