Question: Question 2 2 ( 1 point ) Documentation Inc. currently has a debt - to - equity ratio of 1 . 2 , which is

Question point

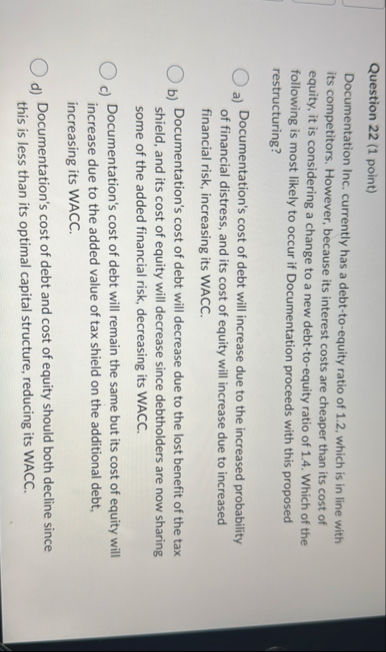

Documentation Inc. currently has a debttoequity ratio of which is in line with its competitors. However, because its interest costs are cheaper than its cost of equity, it is considering a change to a new debttoequity ratio of Which of the following is most likely to occur if Documentation proceeds with this proposed restructuring?

a Documentation's cost of debt will increase due to the increased probability of financial distress, and its cost of equity will increase due to increased financial risk, increasing its WACC.

b Documentation's cost of debt will decrease due to the lost benefit of the tax shield, and its cost of equity will decrease since debtholders are now sharing some of the added financial risk, decreasing its WACC.

c Documentation's cost of debt will remain the same but its cost of equity will increase due to the added value of tax shield on the additional debt, increasing its WACC.

d Documentation's cost of debt and cost of equity should both decline since this is less than its optimal capital structure, reducing its WACC.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock