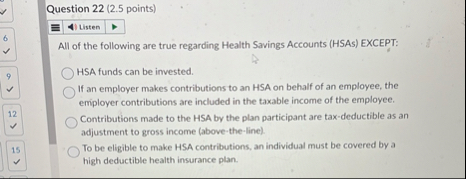

Question: Question 2 2 ( 2 . 5 points ) Listen All of the following are true regarding Health Savings Accounts ( HSAs ) EXCEPT: HSA

Question points

Listen

All of the following are true regarding Health Savings Accounts HSAs EXCEPT:

HSA funds can be invested.

If an employer makes contributions to an HSA on behalf of an employee, the employer contributions are included in the taxable income of the employee.

Contributions made to the HSA by the plan participant are taxdeductible as an adjustment to gross income abovetheline

To be eligible to make HSA contributions, an individual must be covered by a high deductible health insurance plan.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock