Question: Question 2 ( 2 2 marks ) Stephen has been working in the current employer as an HR manager for more than 6 years. His

Question marks

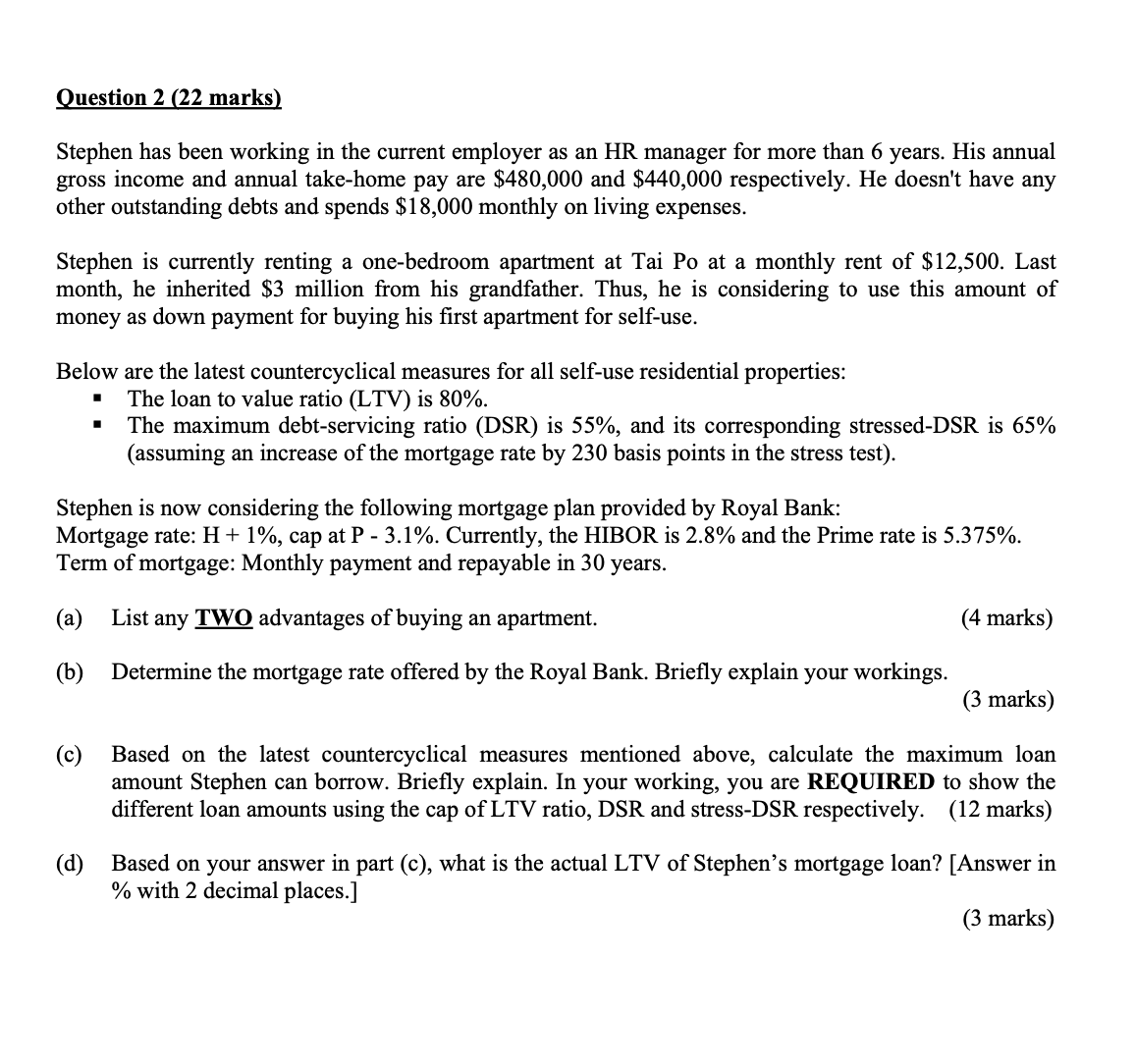

Stephen has been working in the current employer as an HR manager for more than years. His annual

gross income and annual takehome pay are $ and $ respectively. He doesn't have any

other outstanding debts and spends $ monthly on living expenses.

Stephen is currently renting a onebedroom apartment at Tai Po at a monthly rent of $ Last

month, he inherited $ million from his grandfather. Thus, he is considering to use this amount of

money as down payment for buying his first apartment for selfuse.

Below are the latest countercyclical measures for all selfuse residential properties:

The loan to value ratio LTV is

The maximum debtservicing ratio DSR is and its corresponding stressedDSR is

assuming an increase of the mortgage rate by basis points in the stress test

Stephen is now considering the following mortgage plan provided by Royal Bank:

Mortgage rate: cap at Currently, the HIBOR is and the Prime rate is

Term of mortgage: Monthly payment and repayable in years.

a List any TWO advantages of buying an apartment.

b Determine the mortgage rate offered by the Royal Bank. Briefly explain your workings.

c Based on the latest countercyclical measures mentioned above, calculate the maximum loan

amount Stephen can borrow. Briefly explain. In your working, you are REQUIRED to show the

different loan amounts using the cap of LTV ratio, DSR and stressDSR respectively. marks

d Based on your answer in part c what is the actual LTV of Stephen's mortgage loan? Answer in

with decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock