Question: Question 2 ( 2 2 marks ) The following information was taken from the pre - adjustment trial balance of Adventure Stores on 3 1

Question

marks

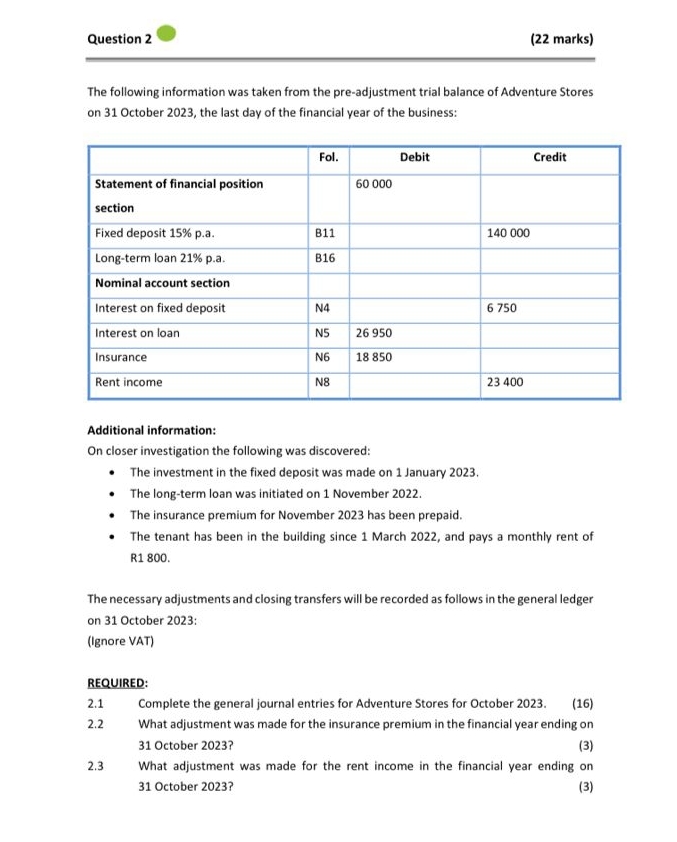

The following information was taken from the preadjustment trial balance of Adventure Stores on October the last day of the financial year of the business:

tableFol.,Debit,CredittableStatement of financial positionsectionFixed deposit paBLongterm loan paBNominal account section,,,Interest on fixed deposit,NInterest on loan,NInsuranceNRent income,N

Additional information:

On closer investigation the following was discovered:

The investment in the fixed deposit was made on January

The longterm loan was initiated on November

The insurance premium for November has been prepaid.

The tenant has been in the building since March and pays a monthly rent of R

The necessary adjustments and closing transfers will be recorded as follows in the general ledger on October :

Ignore VAT

REQUIRED:

Complete the general journal entries for Adventure Stores for October

What adjustment was made for the insurance premium in the financial year ending on October

What adjustment was made for the rent income in the financial year ending on October

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock