Question: Question 2 2 ( 2 points ) 2 Doug decides to start a business transporting toxic waste from the North Dakota oilfields. He has found

Question points

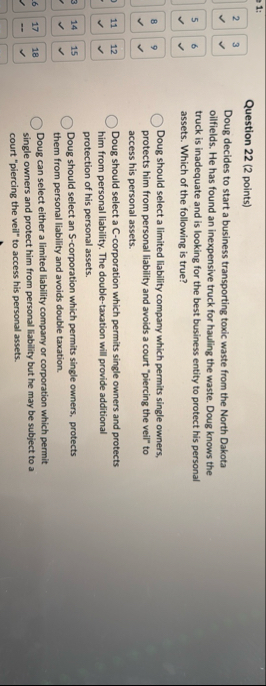

Doug decides to start a business transporting toxic waste from the North Dakota oilfields. He has found an inexpensive truck for hauling the waste. Doug knows the truck is inadequate and is looking for the best business entity to protect his personal assets. Which of the following is true?

Doug should select a limited liability company which permits single owners, protects him from personal liability and avoids a court "piercing the veil" to access his personal assets.

Doug should select a Ccorporation which permits single owners and protects him from personal liability. The doubletaxation will provide additional protection of his personal assets.

Doug should select an Scorporation which permits single owners, protects them from personal liability and avoids double taxation.

Doug can select either a limited liability company or corporation which permit single owners and protect him from personal liability but he may be subject to a court "piercing the veil" to access his personal assets.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock