Question: Question 2 2 3 4 6 2.1 Suppose you long one Australian dollar call and one Australian dollar put with an exercise exchange rate of

Question 2

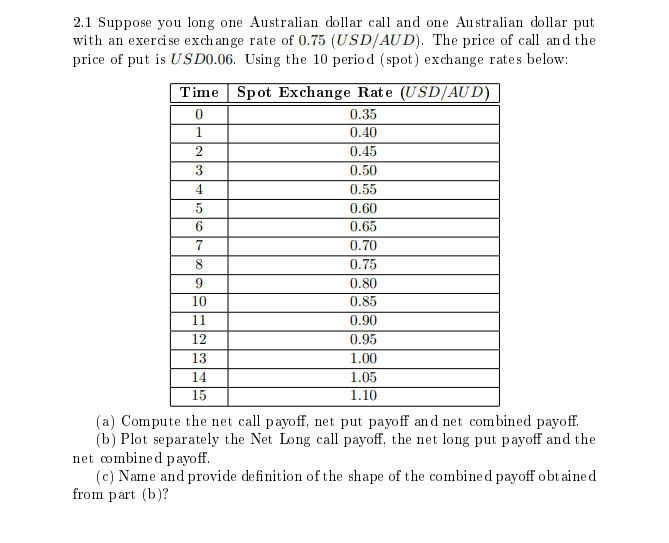

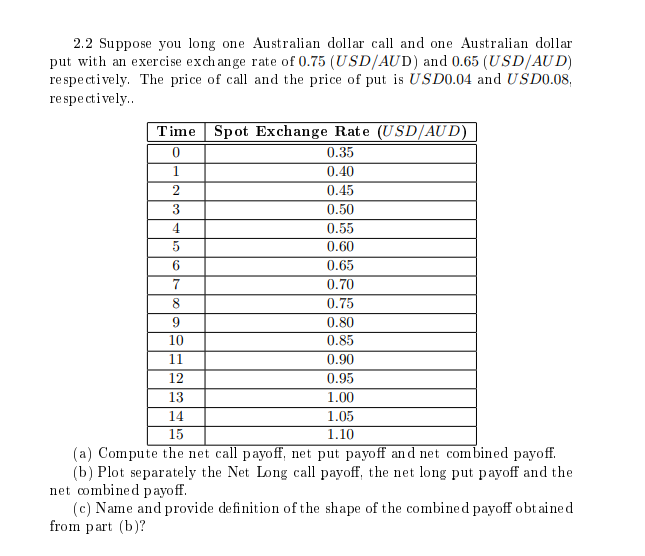

2 3 4 6 2.1 Suppose you long one Australian dollar call and one Australian dollar put with an exercise exchange rate of 0.75 (USD/AUD). The price of call and the price of put is USD0.06. Using the 10 period (spot) exchange rates below: Time Spot Exchange Rate (USD/AUD) 0 0.35 1 0.40 0.45 0.50 0.55 5 0.60 0.65 7 0.70 0.75 0.80 10 0.85 11 0.90 12 0.95 13 1.00 14 1.05 15 1.10 (a) Compute the net call payoff, net put payoff and net combined payoff. (b) Plot separately the Net Long call payoff, the net long put payoff and the net combined payoff. (c) Name and provide definition of the shape of the combined payoff obtained from part (b)? 8 9 0 2.2 Suppose you long one Australian dollar call and one Australian dollar put with an exercise exchange rate of 0.75 (USD/AUD) and 0.65 (USD/AUD) respectively. The price of call and the price of put is USD0.04 and USD0.08, respectively. Time Spot Exchange Rate (USD/AUD) 0.35 1 0.40 2 0.45 3 0.50 4 0.55 0.60 6 0.65 7 0.70 8 0.75 9 0.80 0.85 11 0.90 12 0.95 13 1.00 14 1.05 15 1.10 (a) Compute the net call payoff, net put payoff and net combined payoff. (b) Plot separately the Net Long call payoff, the net long put payoff and the net combined payoff. (c) Name and provide definition of the shape of the combined payoff obtained from part (b)? 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts